Description

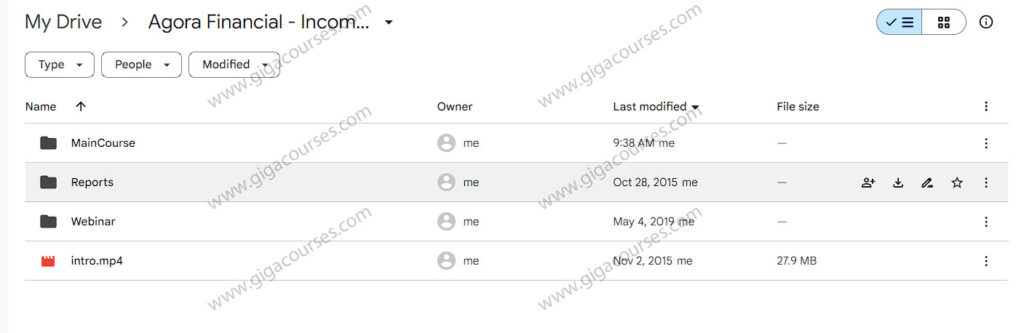

Download Proof | Agora Financial – Income on Demand (1.14 GB)

![]()

Agora Financial Income Demand

Agora Financial’s Income Demand course is designed to help individuals generate consistent and reliable income through strategic financial investments. This course offers insights into various income-generating strategies, focusing on providing practical knowledge and tools for building a steady financial future.

Course Content

Introduction to Income Investing

- Course Goals: Understanding the objectives and expected outcomes.

- Income Investing Basics: Core principles of income-focused investment strategies.

- Market Overview: Current trends and opportunities in income investments.

Dividend-Paying Stocks

- Stock Selection: Criteria for choosing dividend-paying stocks.

- Dividend Yield: Understanding and calculating dividend yields.

- Reinvestment Strategies: Benefits of reinvesting dividends for compound growth.

Fixed-Income Securities

- Bonds and Bond Funds: Types of bonds (government, corporate, municipal) and their benefits.

- Interest Rates: Impact of interest rate changes on bond investments.

- Laddering Strategy: Creating a bond ladder to manage interest rate risk.

Real Estate Investment Trusts (REITs)

- REIT Basics: Understanding how REITs work and their income potential.

- Types of REITs: Equity REITs vs. mortgage REITs.

- Investment Strategies: Selecting and managing REIT investments for steady income.

Annuities and Other Income Products

- Annuities: Overview of different types of annuities (fixed, variable, indexed).

- Income Funds: Exploring mutual funds and ETFs focused on income generation.

- Alternative Investments: Introduction to other income-generating assets like peer-to-peer lending.

Portfolio Management

- Asset Allocation: Diversifying investments to balance risk and income.

- Risk Management: Identifying and mitigating risks associated with income investments.

- Performance Monitoring: Regularly reviewing and adjusting the income portfolio.

Tax Considerations

- Tax-Efficient Investing: Strategies for minimizing taxes on income investments.

- Tax-Advantaged Accounts: Utilizing IRAs, 401(k)s, and other tax-advantaged accounts for income investments.

- Tax Reporting: Understanding tax reporting requirements for various income-generating investments.

Key Features

Expert Guidance

- Experienced Instructors: Learn from financial experts with extensive experience in income investing.

- Guest Speakers: Insights from industry professionals and successful investors.

Interactive Learning

- Webinars: Live and recorded sessions on various income investment topics.

- Q&A Sessions: Regular opportunities to ask questions and receive personalized advice.

- Community Access: Membership in a private community of income-focused investors.

Practical Tools

- Investment Tools: Access to calculators, worksheets, and templates for managing investments.

- Case Studies: Real-world examples of successful income investment strategies.

- Simulations: Practice investment strategies in a risk-free environment using simulated platforms.

Benefits

Financial Stability

- Consistent Income: Strategies for generating reliable and consistent income streams.

- Wealth Preservation: Techniques for preserving and growing wealth through income investments.

- Long-term Security: Building a stable and secure financial future.

Confidence in Investing

- Knowledge Gain: Comprehensive understanding of various income-generating investments.

- Decision-Making: Improved ability to make informed and confident investment decisions.

- Risk Management: Enhanced skills in managing and mitigating investment risks.

Conclusion

Agora Financial’s Income Demand course offers a robust framework for anyone looking to build a steady and reliable income through strategic investing. With its blend of expert instruction, practical tools, and supportive community, this course equips participants with the essential skills and confidence needed to navigate the world of income investing successfully. Whether you’re new to investing or looking to refine your strategies, Income Demand provides the knowledge and resources to help you achieve your financial goals.