Description

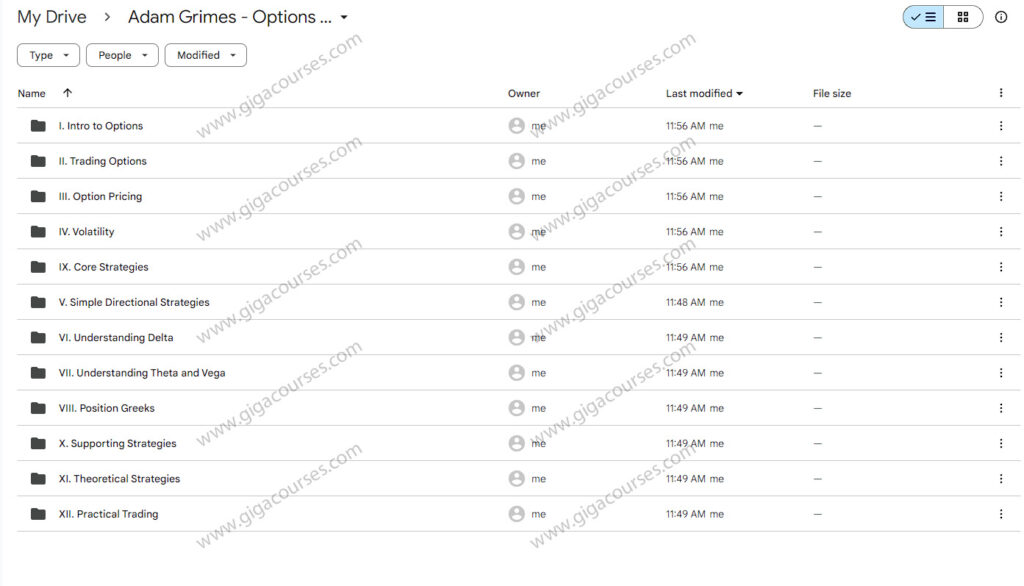

Download Proof | Adam Grimes – Options Course – Market Life Trading (3.47 GB)

![]()

Adam Grimes – Options Course: Mastering the Market with Market Life Trading

Adam Grimes Options Course offered through Market Life Trading is a comprehensive guide designed to equip traders with the knowledge and skills necessary to navigate the complex world of options trading. This course is particularly valuable for those looking to enhance their trading strategies, understand the intricacies of options pricing, and avoid costly mistakes that are common in this challenging market.

Understanding the Greeks: Delta, Theta, Gamma, Vega

One of the foundational aspects of Grimes’ course is a thorough understanding of the Greeks—Delta, Theta, Gamma, and Vega. These metrics are critical in options trading as they provide insights into how an option’s price will change relative to various factors:

- Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. It helps traders understand how much the option price will move for every $1 change in the underlying asset.

- Theta represents the rate of time decay in the value of the option. As options approach expiration, they lose value due to the decreasing amount of time left for the option to become profitable.

- Gamma indicates how much Delta will change in response to a $1 change in the underlying asset’s price. This is particularly important for managing risk as it shows how Delta will shift as the market moves.

- Vega measures the sensitivity of the option’s price to changes in implied volatility. Understanding Vega is crucial for predicting how market volatility will affect option prices.

Why Should You Trade Options?

Options trading offers a range of benefits that can make it an attractive choice for traders. Unlike traditional stock trading, options provide leverage, meaning you can control a large position with a relatively small amount of capital. Additionally, options can be used to hedge existing positions, generate income, and speculate on market movements with limited risk. However, Grimes emphasizes that while options offer many opportunities, they also come with significant risks that must be managed carefully.

Pros and Cons of Different Options Structures

The course delves into the various options structures available to traders, each with its own set of pros and cons:

- Single Options: Trading individual call or put options is straightforward and offers clear-cut risk and reward profiles. However, these positions can be highly sensitive to market movements, requiring precise timing and analysis.

- Spreads: Strategies like vertical spreads, iron condors, and butterflies reduce risk by combining multiple options. These structures can be more forgiving than single options but often cap the potential profit.

- Straddles and Strangles: These strategies are useful in volatile markets where large price swings are expected. However, they require careful management as they can be costly if the market doesn’t move as anticipated.

How and When to Use Different Options Strategies

Adam Grimes’ course provides a detailed exploration of when and how to deploy various options strategies. For example, vertical spreads are ideal in trending markets where a moderate move is expected, while straddles and strangles work best in high-volatility environments. The course teaches traders to assess market conditions, understand their risk tolerance, and choose the appropriate strategy accordingly.

Volatility and Time in Options Pricing

A crucial aspect of options trading is understanding how volatility and time affect options pricing. The course covers how implied volatility can inflate or deflate option prices and how time decay (Theta) erodes the value of options as expiration approaches. By mastering these concepts, traders can better anticipate price movements and make more informed decisions.

Mechanics of Entering and Exiting Trades

Beyond strategy, Grimes emphasizes the importance of mastering the mechanics of entering and exiting trades. The course covers the technical aspects of placing trades, managing positions, and executing exits, ensuring that traders can act swiftly and accurately in the market.

Saving Time and Money

One of the primary goals of Adam Grimes Options Course is to save traders time and money by helping them avoid common mistakes. Options trading is rife with potential pitfalls, and without proper knowledge, traders can easily make errors that cost thousands of dollars. This course aims to shortcut the learning curve, providing traders with the tools and insights needed to become consistently profitable.

Conclusion

Adam Grimes Options Course is an invaluable resource for traders seeking to deepen their understanding of options trading. By focusing on the Greeks, exploring various options structures, and emphasizing the importance of volatility and time, the course equips traders with the knowledge and skills necessary to navigate the options market successfully. Whether you’re a novice or an experienced trader, this course offers insights that can help you trade more effectively and avoid costly mistakes.