Description

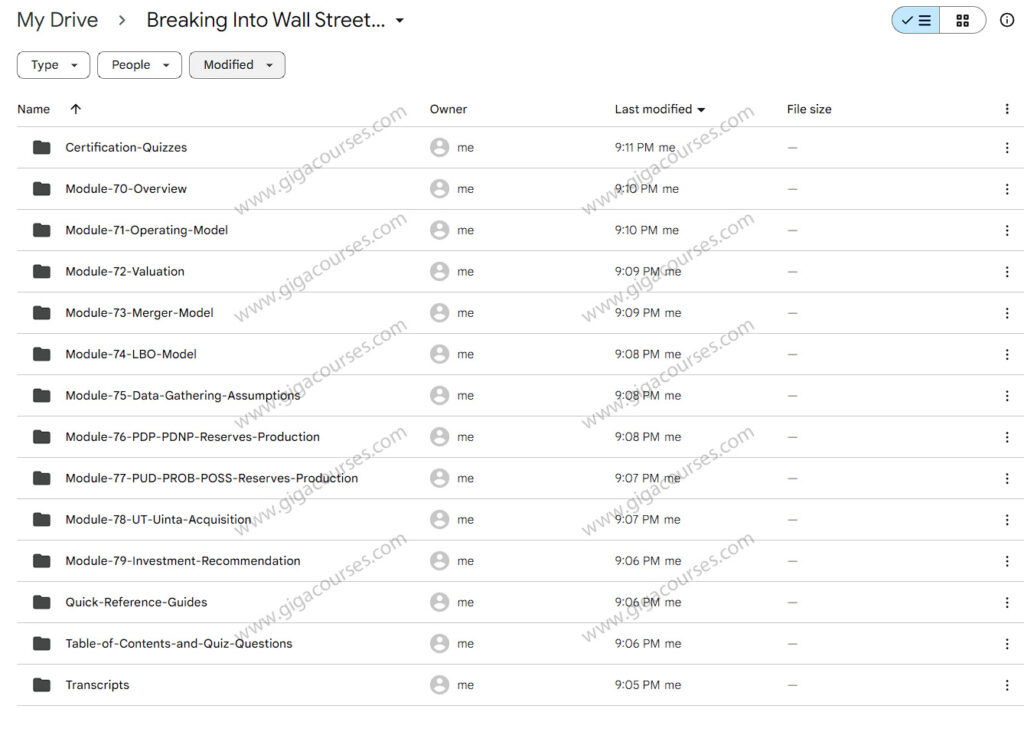

Download Proof |Breaking Into Wall Street – Oil and Gas Modeling (6.79 GB)

![]()

Breaking Into Wall Street – Oil and Gas Modeling Course Overview

Breaking Into Wall Street (BIWS) is a well-known provider of financial modeling courses, tailored to help professionals and students break into competitive industries like investment banking, private equity, and hedge funds. The Oil and Gas Modeling course is a specialized program that focuses on financial modeling for the energy sector, specifically oil and gas companies.

Course Objectives

The Oil and Gas Modeling course aims to equip participants with:

- A deep understanding of the unique financial metrics, valuation techniques, and industry dynamics of the oil and gas sector.

- The ability to build comprehensive financial models from scratch, including revenue and expense forecasts, DCF (Discounted Cash Flow) models, and merger and acquisition (M&A) models.

- Practical skills in assessing the financial health and investment potential of oil and gas companies.

Key Features

- Industry-Specific Content: Unlike generic financial modeling courses, this program focuses exclusively on the oil and gas industry, covering topics like reserves, production, and pricing models unique to this sector.

- Real-Life Case Studies: The course includes detailed case studies and practical exercises based on actual companies and transactions, allowing participants to apply their learning to real-world scenarios.

- Excel-Based Learning: All modeling is done in Excel, with step-by-step instructions, enabling participants to gain hands-on experience with the tools used by industry professionals.

- Self-Paced Learning: The course is entirely online and self-paced, allowing participants to progress at their own speed.

Course Structure

The course is divided into several modules, each focusing on different aspects of oil and gas financial modeling:

- Introduction to the Oil and Gas Industry:

- Overview of the oil and gas sector.

- Understanding the value chain from exploration to production.

- Key industry terms and metrics.

- Revenue and Expense Modeling:

- Modeling production forecasts and revenue streams.

- Estimating operating expenses, capital expenditures, and other costs.

- Valuation Techniques:

- Discounted Cash Flow (DCF) analysis specific to oil and gas companies.

- Net Asset Value (NAV) model construction.

- Comparable company analysis (CCA) and precedent transactions.

- Merger and Acquisition (M&A) Modeling:

- Building pro forma models for potential acquisitions.

- Assessing the impact of mergers and acquisitions on company valuation.

- Analyzing synergies and integration costs.

- Risk and Sensitivity Analysis:

- Stress-testing models with different pricing, production, and cost scenarios.

- Understanding geopolitical, regulatory, and market risks.

- Final Case Study:

- Application of all course concepts to a comprehensive case study.

- Building a full financial model from scratch, including valuation and M&A analysis.

Who Should Take This Course?

This course is ideal for:

- Aspiring Financial Analysts: Those seeking to specialize in the energy sector, particularly oil and gas.

- Investment Bankers: Professionals looking to enhance their industry-specific modeling skills.

- Private Equity and Hedge Fund Analysts: Individuals interested in energy sector investments.

- Corporate Finance Professionals: Finance professionals working in or targeting roles in oil and gas companies.

- Students: University students in finance, economics, or related fields preparing for a career in investment banking or the energy sector.

Course Benefits

- Comprehensive Skill Development: Gain a deep understanding of financial modeling tailored to the oil and gas industry.

- Practical Application: Work on real-life case studies and build models that can be used in professional settings.

- Career Advancement: Enhance your resume with specialized skills that are highly valued in investment banking and energy finance..

Conclusion

The Breaking Into Wall Street – Oil and Gas Modeling course is a robust program designed to provide participants with the specific skills needed to excel in financial analysis and valuation within the oil and gas sector. Whether you’re a professional looking to advance your career or a student aiming to enter the industry, this course offers valuable insights and practical experience that can set you apart in the competitive world of finance.