Description

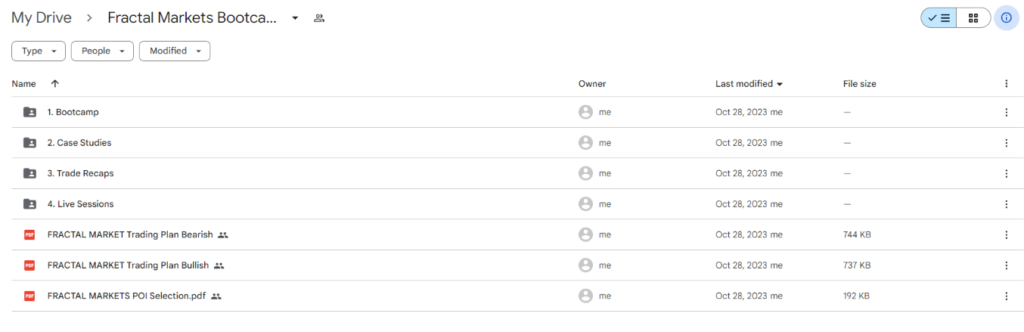

Download Proof | Fractal Markets Bootcamp (4.41 GB)

![]()

Fractal Markets Bootcamp

Title: Navigating Financial Complexity: Fractal Markets Bootcamp

Introduction: Fractal Markets Bootcamp, a cutting-edge training program, is designed to equip traders with the skills to understand and leverage the intricacies of fractal patterns within financial markets. Developed by industry expert John Masters, this bootcamp explores the concept of market fractals, empowering participants to gain a deeper comprehension of market dynamics and make informed trading decisions.

I. Unraveling the Essence of Fractal Patterns: The bootcamp commences by elucidating the fundamental principles of fractal patterns within financial markets. Participants delve into the concept of self-similar patterns repeating across different timeframes, providing a unique lens through which to analyze market structures. Understanding the fractal nature of markets becomes a cornerstone for traders looking to identify patterns and trends effectively.

II. Integrating Chaos Theory into Trading Strategies: Fractal Markets Bootcamp seamlessly integrates Chaos Theory into practical trading strategies. John Masters elucidates how seemingly chaotic market movements can exhibit underlying patterns and order. By embracing Chaos Theory, traders gain a deeper appreciation for the randomness of markets, learning to discern patterns within apparent chaos and apply this insight to optimize their trading strategies.

III. Timeframe Synchronization Techniques: A distinctive feature of the bootcamp is the exploration of timeframe synchronization techniques. Masters guides participants on how to align multiple timeframes to identify confluence zones and enhance the accuracy of trading signals. This synchronization approach enables traders to develop a comprehensive understanding of market trends and make more informed decisions.

IV. Advanced Technical Analysis with Fractals: Fractal Markets Bootcamp delves into advanced technical analysis, leveraging fractals as a tool for forecasting price movements. Traders learn how to identify key support and resistance levels, trend reversals, and potential breakout points through the lens of fractal patterns. This integration of fractals into technical analysis provides participants with a unique edge in predicting market behavior.

V. Risk Management in Fractal Trading: Recognizing the inherent complexities of fractal-based trading, the bootcamp places a strong emphasis on risk management strategies. Masters guides participants on how to set effective stop-loss levels, manage position sizes, and protect capital amidst the dynamic nature of fractal markets. This focus on risk management ensures that traders can navigate the complexities of fractal trading with prudence and discipline.

VI. Real-world Application through Case Studies: Fractal Markets Bootcamp enhances the learning experience by illustrating theoretical concepts through real-world application and case studies. Participants gain practical insights into how fractal patterns manifest in actual market scenarios, providing them with tangible examples to reinforce their understanding. The integration of case studies ensures that participants are well-prepared to apply the learned principles in live trading environments.

Conclusion: Fractal Markets Bootcamp emerges as a transformative educational resource for traders seeking to navigate financial markets through the lens of fractal patterns. By unraveling the essence of fractals, integrating Chaos Theory, exploring timeframe synchronization techniques, and applying advanced technical analysis, John Masters provides a comprehensive toolkit. The bootcamp’s emphasis on risk management and real-world application solidifies its value, making it an essential resource for traders aiming to thrive in the dynamic landscape of fractal markets.