Description

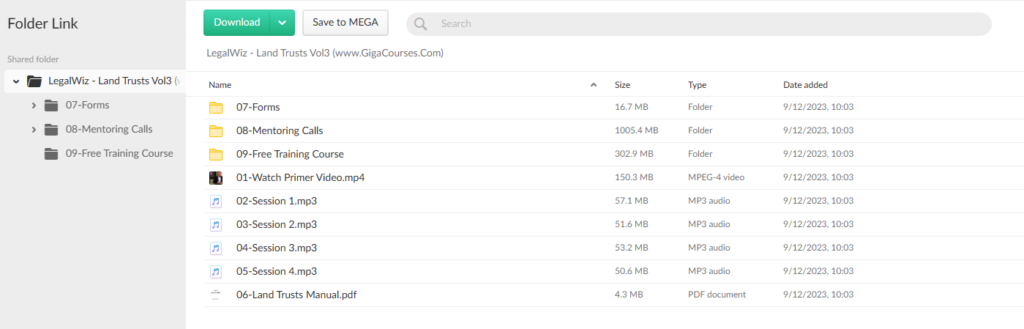

Download Proof | LegalWiz – Land Trusts Vol3 (1.65 GB)

![]()

LegalWiz – Land Trusts Vol3

Introduction: LegalWiz’s Land Trusts Vol. 3 is a comprehensive resource that delves into the intricacies of land trusts, providing valuable insights for individuals navigating real estate transactions. In this volume, LegalWiz focuses on advanced strategies and nuanced aspects of land trusts, offering a deeper understanding of their application in real estate planning and investment.

Advanced Land Trust Strategies: The volume begins by delving into advanced land trust strategies, showcasing how these legal instruments can be utilized beyond basic asset protection. LegalWiz explores intricate methods for maximizing the benefits of land trusts, such as leveraging them for estate planning purposes, protecting privacy, and facilitating seamless real estate transactions. Readers gain a nuanced perspective on the versatility of land trusts in various scenarios.

Tax Planning and Land Trusts: LegalWiz recognizes the crucial role of tax planning in real estate endeavors and expounds on how land trusts can be integrated into a comprehensive tax strategy. This section elucidates the tax advantages associated with land trusts, including potential reductions in property taxes and effective estate tax planning. By incorporating land trusts into a broader tax planning framework, individuals can optimize their financial outcomes while safeguarding their real estate assets.

Creative Financing Techniques: One of the highlights of Land Trusts Vol. 3 is its exploration of creative financing techniques facilitated by land trusts. LegalWiz outlines innovative approaches for structuring real estate deals using land trusts, including seller financing, lease options, and subject-to transactions. These strategies provide readers with alternative avenues for financing real estate acquisitions and maximizing returns on investment.

Asset Protection Strategies: In this section, LegalWiz delves into advanced asset protection strategies utilizing land trusts. Readers gain insights into shielding real estate assets from potential legal threats and creditor claims. The volume explores the nuances of structuring land trusts to enhance asset protection, safeguarding property ownership while maintaining flexibility in managing real estate portfolios.

Navigating Legal Complexities: Land Trusts Vol. 3 addresses the legal intricacies associated with land trusts, equipping readers with the knowledge needed to navigate potential challenges. LegalWiz provides guidance on compliance with legal requirements, drafting effective trust agreements, and ensuring proper documentation for seamless real estate transactions. Understanding and mitigating legal risks is essential for individuals seeking to harness the full potential of land trusts.

Conclusion: LegalWiz’s Land Trusts Vol. 3 emerges as a valuable resource for real estate professionals, investors, and individuals looking to elevate their understanding of land trusts. By exploring advanced strategies, tax planning nuances, creative financing techniques, asset protection strategies, and legal considerations, the volume goes beyond the basics, offering a comprehensive guide to leveraging land trusts in diverse real estate scenarios. LegalWiz empowers readers to make informed decisions, optimize financial outcomes, and navigate the legal landscape with confidence, making Land Trusts Vol. 3 an indispensable tool for those seeking mastery in real estate transactions involving land trusts.