Description

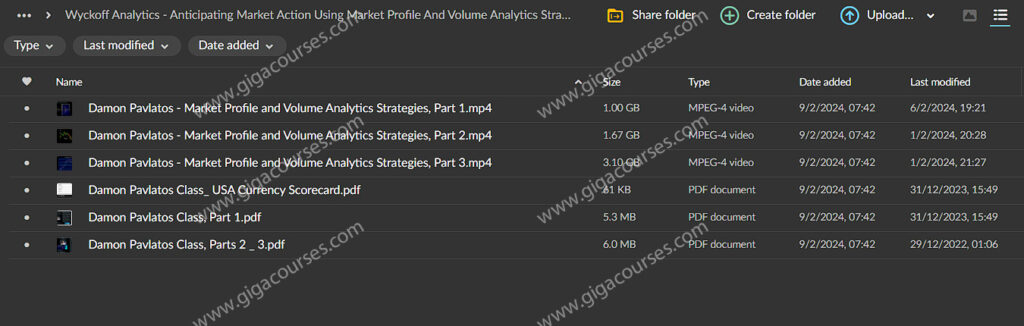

Download Proof | Wyckoff Analytics – Anticipating Market Action Using Market Profile And Volume Analytics Strategies (864.7 MB)

![]()

Wyckoff Analytics – Anticipating Market Action Using Market Profile And Volume Analytics Strategies

Title: Anticipating Market Action with Wyckoff Analytics: Leveraging Market Profile and Volume Analytics Strategies

Introduction: Wyckoff Analytics offers a comprehensive approach to understanding market dynamics through the integration of Market Profile and Volume Analytics strategies. By combining these methodologies, traders gain a deeper insight into market sentiment, structure, and potential price movements. This article explores how Wyckoff Analytics enables traders to anticipate market action effectively.

Understanding Market Profile: Market Profile is a graphical representation of price and volume data plotted on a horizontal histogram. It provides traders with a visual depiction of where trading activity occurs most frequently within a given time frame. Understanding Market Profile involves analyzing key components such as value area, point of control, and excess highs or lows. Traders utilize this information to identify areas of balance and imbalance in the market, facilitating more informed trading decisions.

Analyzing Volume Analytics: Volume Analytics focuses on interpreting volume patterns to gauge market participation and strength. By analyzing volume alongside price movements, traders can assess the validity of price trends and identify potential reversal points. Volume Analytics techniques include volume profile analysis, volume-at-price charts, and volume-based indicators. These tools help traders identify significant support and resistance levels, as well as detect shifts in market sentiment based on changes in trading volume.

Anticipating Market Action with Wyckoff Analytics: Wyckoff Analytics combines the insights from Market Profile and Volume Analytics to anticipate market action effectively. Traders use Wyckoff principles, such as the Law of Supply and Demand and the Composite Operator Theory, to interpret market dynamics within the context of accumulation and distribution phases. By applying Wyckoff analysis alongside Market Profile and Volume Analytics, traders can identify optimal entry and exit points with a higher probability of success.

Identifying Accumulation and Distribution Phases: Accumulation and distribution phases represent periods of institutional buying or selling, respectively. Wyckoff Analytics helps traders recognize the subtle signs of these phases through the analysis of price and volume patterns. During accumulation, prices tend to consolidate within a defined range, accompanied by increasing volume on upswings and decreasing volume on downswings. Conversely, distribution phases are characterized by narrowing price ranges and diminishing volume, indicating a lack of buying interest.

Utilizing Market Profile to Confirm Wyckoff Phases: Market Profile analysis complements Wyckoff principles by providing additional confirmation of accumulation and distribution phases. Traders look for specific Market Profile structures, such as prominent points of control and value areas, to validate the presence of buying or selling pressure. Additionally, volume profiles can reveal areas of high-volume nodes within the Market Profile, indicating significant levels of market participation and potential turning points.

Applying Volume Analytics for Confirmation: Volume Analytics serves as a critical tool for confirming Wyckoff phases and identifying potential trade setups. Traders pay close attention to volume patterns, such as volume spikes or divergences, which may signal the initiation or exhaustion of a price trend. By aligning volume analysis with Wyckoff principles and Market Profile structures, traders can enhance their confidence in anticipating market action and making informed trading decisions.

Conclusion: Wyckoff Analytics offers traders a powerful framework for anticipating market action by integrating Market Profile and Volume Analytics strategies. Through the application of Wyckoff principles, traders gain insights into market sentiment and structure, enabling them to identify accumulation and distribution phases with greater precision. By combining these methodologies, traders can develop a deeper understanding of market dynamics and improve their ability to navigate various market conditions effectively.