Description

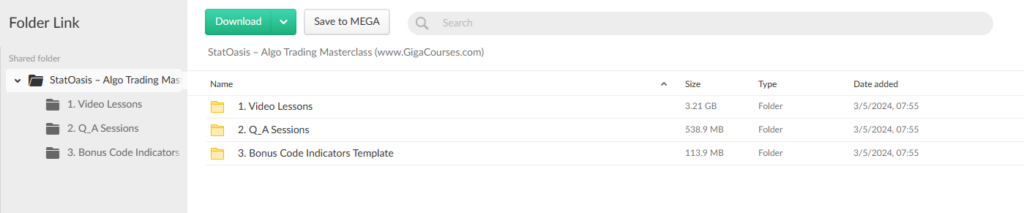

Download Proof | StatOasis – Algo Trading Masterclass (3.84 GB)

![]()

StatOasis – Algo Trading Masterclass

Introduction to StatOasis – Algo Trading Masterclass

StatOasis – Algo Trading Masterclass is a comprehensive program designed to equip participants with the knowledge and skills needed to excel in algorithmic trading. Led by experts in quantitative finance and algorithmic trading, this masterclass offers a structured curriculum that covers key concepts, strategies, and techniques for building and deploying algorithmic trading systems. Through a combination of theoretical concepts, practical examples, and hands-on exercises, participants learn how to leverage data analysis, statistical modeling, and programming to develop profitable trading strategies and achieve success in financial markets.

Understanding Algorithmic Trading Fundamentals

At the core of the Algo Trading Masterclass is understanding the fundamentals of algorithmic trading and its role in modern financial markets. Participants gain insights into the principles of algorithmic trading, including market microstructure, order types, and execution strategies. By understanding the advantages of algorithmic trading, such as speed, accuracy, and scalability, participants can appreciate its importance in achieving trading objectives and maximizing returns.

Data Analysis and Statistical Modeling

Data analysis and statistical modeling are essential components of algorithmic trading, and the masterclass provides participants with the tools and techniques needed to analyze financial data and develop predictive models. Participants learn how to collect, clean, and preprocess historical market data, as well as how to apply statistical techniques such as time series analysis, regression analysis, and machine learning to identify trading opportunities and forecast market trends.

Building and Testing Trading Strategies

The masterclass guides participants through the process of building and testing trading strategies using historical market data. Participants learn how to formulate trading ideas, define entry and exit criteria, and implement trading rules using programming languages such as Python or R. Through backtesting and simulation, participants can evaluate the performance of their trading strategies under various market conditions and optimize them for maximum profitability and risk management.

Risk Management and Portfolio Optimization

Effective risk management and portfolio optimization are crucial for success in algorithmic trading, and the masterclass offers participants strategies for managing risk and constructing diversified portfolios. Participants learn how to calculate risk metrics such as value at risk (VaR) and drawdowns, as well as how to implement risk controls and position sizing techniques to protect capital and minimize losses. Additionally, participants learn how to optimize portfolio allocation and rebalance portfolios dynamically to maximize returns while controlling risk.

Implementing Automated Trading Systems

The masterclass provides participants with insights into the process of implementing automated trading systems and integrating them into live trading environments. Participants learn about different trading platforms and execution algorithms, as well as how to deploy their trading strategies using application programming interfaces (APIs) provided by brokerage firms or third-party trading platforms. By automating trade execution and monitoring, participants can take advantage of market opportunities in real-time and reduce the impact of human emotions on trading decisions.

Conclusion

StatOasis – Algo Trading Masterclass offers participants a comprehensive education in algorithmic trading, covering key concepts, strategies, and techniques for building and deploying profitable trading systems. By understanding algorithmic trading fundamentals, mastering data analysis and statistical modeling, building and testing trading strategies, implementing risk management and portfolio optimization techniques, and deploying automated trading systems, participants can achieve success in financial markets and generate consistent returns over time. With practical guidance, hands-on exercises, and expert insights, this masterclass empowers participants to excel in algorithmic trading and capitalize on opportunities in global financial markets.