Description

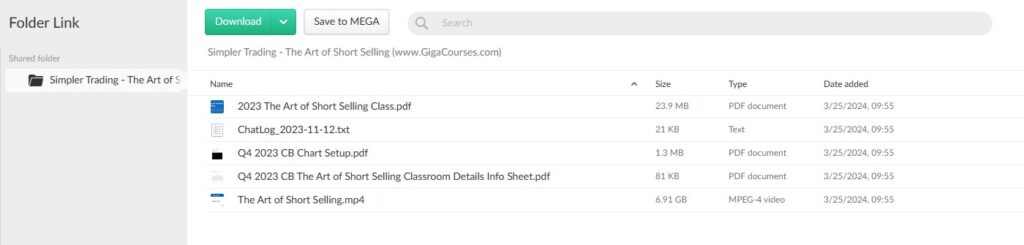

Download Proof | Simpler Trading – The Art of Short Selling (6.94 GB)

![]()

Simpler Trading – The Art of Short Selling

Introduction to Simpler Trading and Short Selling

Simpler Trading, a leading platform for trading education and market analysis, offers a comprehensive course on the art of short selling. Short selling is a sophisticated trading strategy that allows investors to profit from the decline in the price of a security. With Simpler Trading’s expertise and guidance, participants learn the ins and outs of short selling, including techniques for identifying shorting opportunities, managing risk, and maximizing profits in both bull and bear markets.

Understanding Short Selling

Short selling involves borrowing shares of a stock from a broker and selling them on the open market with the expectation that the price will fall. Once the price declines, the trader buys back the shares at a lower price and returns them to the broker, pocketing the difference as profit. Short selling allows traders to profit from falling markets or overvalued stocks, providing a hedge against downturns and diversifying their trading strategies.

Key Concepts and Strategies

Simpler Trading’s course on short selling covers a range of key concepts and strategies essential for success in this trading approach. These may include:

- Identifying Weakness in Stocks: Participants learn how to identify stocks that are overvalued or exhibiting signs of weakness, such as deteriorating fundamentals, negative news catalysts, or technical breakdowns. By conducting thorough analysis and due diligence, traders can pinpoint potential candidates for short selling with confidence.

- Risk Management Techniques: Short selling carries inherent risks, including the potential for unlimited losses if the price of a stock continues to rise. Simpler Trading teaches participants effective risk management techniques, such as setting stop-loss orders, implementing position sizing strategies, and using options to hedge against adverse price movements.

- Timing Entries and Exits: Timing is critical in short selling, as traders aim to enter positions at optimal points and cover their shorts before prices rebound. The course explores various techniques for timing entries and exits, including technical indicators, chart patterns, and market sentiment analysis.

Psychology of Short Selling

Short selling requires a unique mindset and psychological resilience, as traders must be comfortable profiting from downward price movements and managing the emotions that come with taking contrarian positions. Simpler Trading delves into the psychology of short selling, helping participants develop the discipline, patience, and emotional intelligence needed to navigate volatile markets and stay focused on their trading objectives.

Real-World Application and Case Studies

Throughout the course, Simpler Trading provides real-world examples and case studies to illustrate the principles and strategies of short selling in action. By analyzing past trades and market scenarios, participants gain valuable insights into the practical application of short selling techniques and the factors that drive success in this trading approach. These case studies serve as valuable learning tools, allowing traders to learn from both successes and failures and refine their approach accordingly.

Conclusion

In conclusion, Simpler Trading’s course on the art of short selling offers traders a comprehensive education in this sophisticated trading strategy. Through in-depth instruction, practical techniques, and real-world examples, participants gain the knowledge and skills needed to profitably navigate bearish market conditions and capitalize on downside opportunities. Whether you’re a seasoned trader looking to diversify your portfolio or a newcomer seeking to learn a new skill, Simpler Trading’s course equips you with the tools and confidence to succeed in the art of short selling.