Description

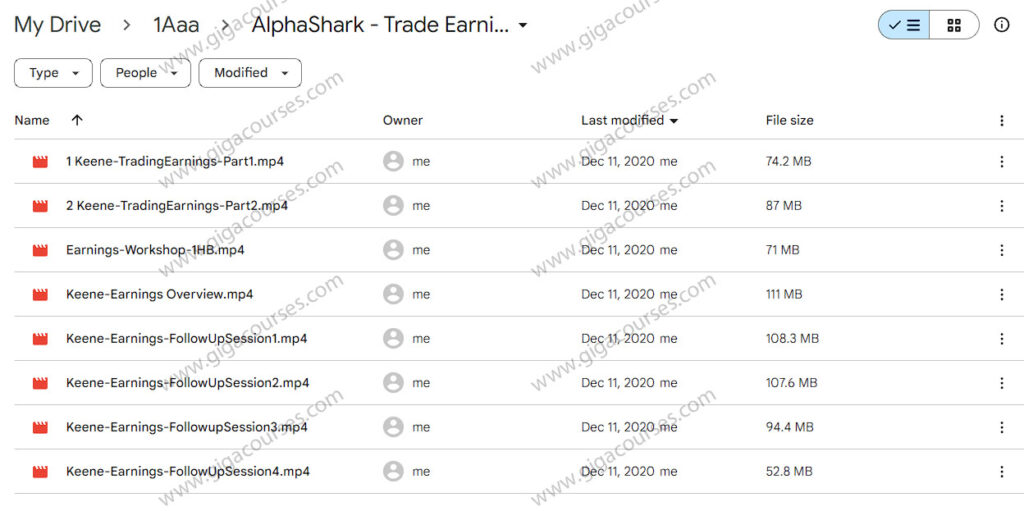

Download Proof | AlphaShark – Trade Earnings Using Measured Move (706 MB)

![]()

AlphaShark – Trade Earnings Using Measured Move

The AlphaShark course, Trade Earnings Using Measured Move, focuses on utilizing the measured move strategy to capitalize on earnings reports. The course equips traders with techniques to analyze stock price behavior before and after earnings announcements, enabling them to execute more precise and informed trades.

Key Concepts Covered

- Measured Move Strategy

A deep dive into how to predict price movements based on historical stock behavior surrounding earnings reports. This strategy is aimed at identifying the most probable price range after earnings announcements. - Earnings Reports as Catalysts

Understanding how earnings reports can serve as major catalysts for stock price volatility and how traders can position themselves ahead of these events. - Options Trading for Earnings

The course covers how to utilize options (calls and puts) to profit from post-earnings price movement. Traders are taught to minimize risk while maximizing returns.

Course Structure

- Introduction to Earnings and Market Reactions

Explains the importance of earnings season and the typical reactions stocks have after companies release their earnings reports. - Measuring Price Moves

Teaches how to measure historical price moves post-earnings and apply this knowledge to predict future movements. - Selecting the Right Stocks

Criteria for selecting the best stocks to trade during earnings season, focusing on liquidity, volatility, and historical earnings patterns. - Risk Management Techniques

The course emphasizes managing risk, especially in high-volatility periods such as earnings announcements. It explores various strategies to protect capital and ensure calculated trades.

Benefits of the Course

- Increased Profit Potential

By trading around earnings using the measured move strategy, traders can exploit large price swings for potentially higher profits. - Better Risk Control

Options strategies taught in the course help traders manage the inherent risk of earnings trading, such as straddles and strangles. - Actionable Insights

The course offers practical, step-by-step guidance to help traders make informed decisions with real-world applicability during earnings season.

Who Is This Course For?

- Intermediate to Advanced Traders

This course is ideal for traders who have a solid understanding of the stock market and options trading and are looking to capitalize on earnings season volatility. - Risk-Averse Traders

Traders who prefer well-calculated, measured moves with defined risk profiles will benefit from this strategy.

Conclusion

AlphaShark – Trade Earnings Using Measured Move provides a systematic approach to earnings trading, focusing on historical analysis and calculated strategies. It is a must for traders seeking to make profits during volatile earnings periods while managing risk efficiently.