Description

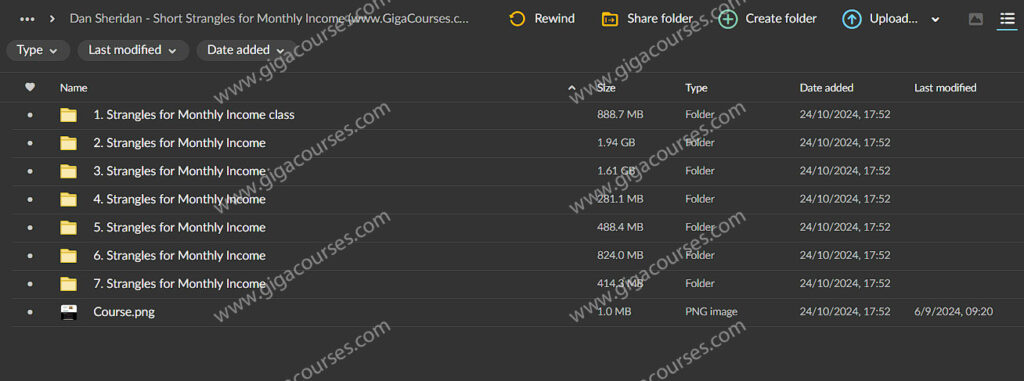

Download Proof | Dan Sheridan – Short Strangles for Monthly Income (6.38 GB)

![]()

Dan Sheridan – Short Strangles for Monthly Income

The Dan Sheridan – Short Strangles for Monthly Income course is designed for options traders seeking a reliable strategy to generate consistent monthly income. Dan Sheridan, an experienced options trading coach, introduces a conservative yet profitable strategy that utilizes short strangles—a neutral options strategy where traders sell both a put and a call option on the same underlying asset, aiming to profit from stable, low-volatility markets.

This course caters to traders who want to harness the power of theta decay and effectively manage risk while generating steady returns.

Key Learning Outcomes

- Master the Short Strangle Strategy: Learn how to effectively execute the short strangle strategy to profit from market stagnation or limited price movements.

- Risk Management Techniques: Understand how to limit downside risk and protect profits while trading short strangles.

- Maximizing Monthly Income: Focus on generating monthly returns using conservative option selling strategies.

- Managing Low Volatility Markets: Adapt the short strangle approach to different market environments, particularly low volatility periods.

- Practical Trade Adjustments: Learn how to adjust positions in response to market changes to protect capital and optimize profits.

Course Structure

- Introduction to Short Strangles

- Overview of options basics: calls and puts

- Defining short strangles and their risk/reward profile

- When to use short strangles for income generation

- Key characteristics of markets suitable for short strangles

- Executing the Strategy

- Step-by-step process for setting up short strangles

- Understanding the role of implied volatility (IV) in short strangles

- Selecting the right strike prices and expiration dates

- Choosing underlying assets with minimal price movement

- Managing Risk and Adjusting Positions

- How to set and manage stop-loss levels

- Managing positions when the market moves against you

- Adjustment techniques to minimize losses, including rolling positions and converting trades

- Diversifying short strangles across multiple assets to reduce risk

- Generating Consistent Monthly Income

- Leveraging theta decay for predictable returns

- Timing short strangles for optimal income generation

- Managing premium collection to build steady monthly income

- Understanding the role of time decay and volatility in generating profits

- Real-World Application and Examples

- Case studies of short strangles in live market scenarios

- Practical examples of trade setup and management

- Live trading sessions with Dan Sheridan to see strategy execution in real time

- Risk Management and Capital Preservation

- How to maintain a strong risk-to-reward ratio

- Position sizing and capital allocation for short strangles

- Monitoring market conditions to adapt your approach as necessary

- Implementing defensive strategies when market conditions change

Why Choose This Course?

- Proven Income Strategy: The short strangle strategy taught by Dan Sheridan is designed to generate reliable monthly income, making it ideal for traders looking for consistency.

- Emphasis on Risk Management: The course places strong emphasis on managing the inherent risks associated with selling options, giving traders the tools to protect their capital.

- Adaptable to Various Market Conditions: Although the strategy works best in low-volatility markets, Dan Sheridan teaches how to adjust and adapt the strategy in different market environments.

- Comprehensive Training from an Expert: With decades of experience, Dan Sheridan offers deep insights and practical advice, helping traders understand both the theory and application of the strategy.

Benefits of Enrolling

- Steady Monthly Income: The course focuses on building a system where traders can expect regular, monthly income through short strangles.

- In-Depth Risk Management Guidance: Traders will learn how to protect their positions and avoid significant losses by applying strategic adjustments.

- Access to Real-World Examples: Dan Sheridan provides live trade examples, allowing students to see the strategy in action and learn how to apply it in real-time scenarios.

- Suitable for Intermediate and Advanced Traders: While beginners can learn from the course, it is most suited for traders with an understanding of options who want to refine their skills.

Conclusion

The Dan Sheridan – Short Strangles for Monthly Income course equips traders with a robust strategy for generating monthly returns while managing risk. By focusing on short strangles, traders can capitalize on time decay and low volatility, making it an effective strategy for consistent income. With Dan Sheridan’s expert guidance, traders will not only learn how to execute the strategy but also how to adjust and optimize it for maximum profitability in different market conditions.