Description

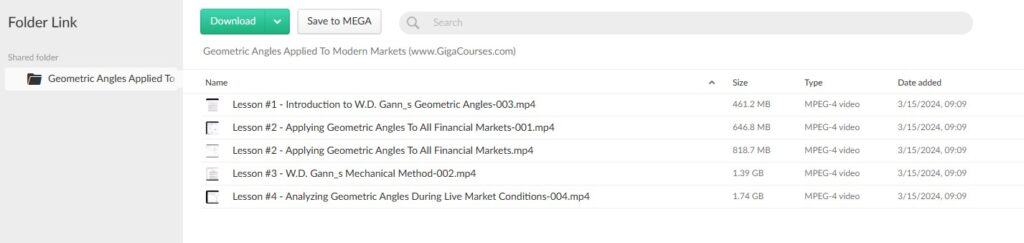

Download Proof | Geometric Angles Applied To Modern Markets (5.01 GB)

![]()

Geometric Angles Applied To Modern Markets

Introduction: Applying geometric angles to modern markets represents a fusion of traditional technical analysis with contemporary financial methodologies. This approach, rooted in principles of geometry and mathematics, offers traders and investors a unique perspective on market behavior and trend analysis. By understanding how geometric angles intersect with price movements, market participants can make more informed decisions and enhance their trading strategies.

Foundations of Geometric Angles: Geometric angles, such as Fibonacci retracements, Gann angles, and Andrews’ pitchfork, are based on mathematical principles and geometric relationships. These tools enable traders to identify potential support and resistance levels, forecast price movements, and determine key inflection points within market trends. Understanding the foundational concepts of geometric angles is essential for effectively applying them to modern markets.

Fibonacci Retracements and Extensions: Fibonacci retracements, derived from the Fibonacci sequence, are widely used in technical analysis to identify potential reversal levels in price trends. Traders apply Fibonacci retracement levels to gauge potential areas of support or resistance where price may reverse or consolidate. Additionally, Fibonacci extensions project potential price targets beyond the initial trend, providing valuable insights for setting profit targets and managing risk.

Gann Angles and Time Analysis: Gann angles, developed by legendary trader W.D. Gann, are based on the premise that price movements exhibit geometric relationships over time. These angles are drawn from significant highs and lows in price charts and provide insights into the timing of trend reversals or continuations. By combining price and time analysis, Gann angles offer a holistic approach to market forecasting and trend prediction.

Andrews’ Pitchfork and Trend Channels: Andrews’ pitchfork, named after Alan Andrews, is a tool used to identify trend channels and potential reversal points within price trends. By drawing three parallel lines based on significant price pivots, traders can visualize potential areas of support and resistance and anticipate future price movements. Andrews’ pitchfork is particularly useful for identifying trend channels and assessing the strength and direction of market trends.

Application to Modern Markets: In modern markets characterized by high-frequency trading and algorithmic strategies, the application of geometric angles offers traders a unique advantage. By incorporating geometric analysis into their trading methodologies, traders can gain insights into market sentiment, identify hidden patterns, and anticipate potential turning points with greater precision. Whether trading stocks, forex, commodities, or cryptocurrencies, the principles of geometric angles provide a universal framework for market analysis.

Risk Management and Integration: While geometric angles offer valuable insights into market dynamics, effective risk management remains paramount. Traders must integrate geometric analysis with robust risk management strategies to protect capital and preserve profitability. This involves setting stop-loss orders, diversifying portfolios, and adhering to disciplined trading plans to mitigate potential losses.

Conclusion: The application of geometric angles to modern markets represents a fusion of mathematical principles with technical analysis methodologies. By understanding the foundations of geometric angles and applying tools such as Fibonacci retracements, Gann angles, and Andrews’ pitchfork, traders can gain valuable insights into market trends and price movements. Integrating geometric analysis with effective risk management strategies enhances trading decision-making and empowers traders to navigate dynamic market conditions with confidence. Whether identifying potential reversal points, projecting price targets, or assessing trend strength, geometric angles offer traders a versatile toolkit for market analysis and forecasting.