Description

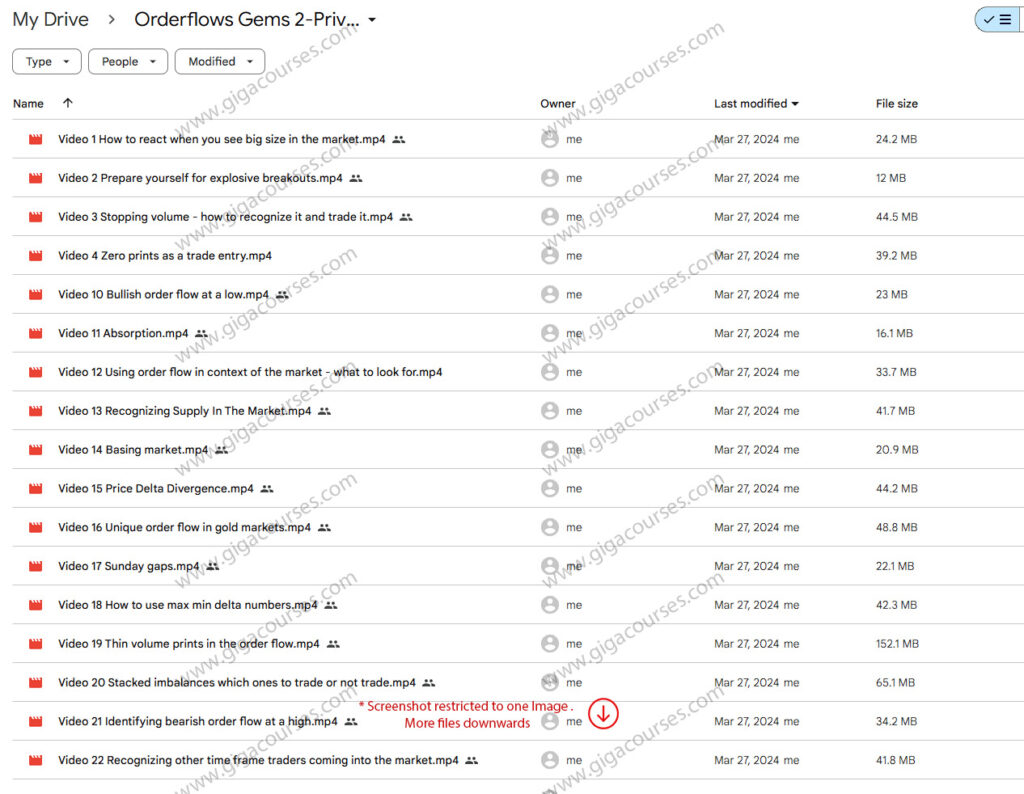

Download Proof | Orderflows Gems 2-Private Sessions (1.59 GB)

![]()

Orderflows Gems 2: Private Sessions – Advanced Market Insights

Orderflows Gems 2: Private Sessions is a specialized course tailored for traders who want to deepen their understanding of market dynamics through order flow analysis. This program offers a unique opportunity to learn directly from experts in private sessions, where participants gain advanced strategies to read and leverage order flow data. The course equips traders with essential tools and techniques to interpret market movements, enhancing their trading skills and decision-making processes.

Key Course Highlights

1. In-Depth Order Flow Analysis

- Learn the fundamental principles of order flow, enabling traders to interpret the intentions behind large market orders.

- Gain insights into reading real-time order flow data to make informed trading decisions based on actual market activity rather than just technical indicators.

2. Exclusive Private Sessions

- Benefit from personalized learning experiences in private sessions designed for small groups.

- Engage in interactive sessions with expert instructors who provide tailored advice, answer questions, and offer real-time feedback on trading strategies.

3. Advanced Market Structure Understanding

- Master the intricacies of market structure, identifying key levels of support and resistance based on order flow data.

- Understand how to spot and respond to market manipulation, volume imbalances, and other structural patterns that impact price action.

Essential Learning Modules

Module 1: Core Order Flow Concepts

- Objective: Build a foundational understanding of order flow, covering essential concepts such as volume analysis, bid-ask imbalances, and liquidity zones.

- Outcome: Gain clarity on how order flow drives price changes, equipping traders to read market intent accurately.

Module 2: Practical Application of Order Flow Tools

- Objective: Learn to use specialized order flow tools and platforms for real-time data analysis.

- Outcome: Acquire hands-on skills with tools like footprint charts, delta analysis, and volume profile to recognize high-probability trade setups.

Module 3: Identifying Market Traps and Manipulation

- Objective: Understand common patterns of market manipulation, including false breakouts and liquidity traps.

- Outcome: Develop strategies to avoid common trading pitfalls and identify opportunities when institutional traders attempt to influence price movement.

Module 4: Building a Strategy Around Order Flow

- Objective: Combine technical analysis with order flow data to create a comprehensive trading strategy.

- Outcome: Formulate a strategy that integrates real-time order flow signals, allowing traders to react swiftly to emerging opportunities.

Key Benefits of Orderflows Gems 2: Private Sessions

- Enhanced Market Timing: By analyzing order flow, traders learn to improve their entry and exit points, capturing trades with better timing and accuracy.

- Risk Management Techniques: Understand how order flow can reveal when to tighten stop-loss orders or exit positions, reducing exposure to market risk.

- Hands-On Guidance from Experts: Private sessions ensure individualized support, helping traders address specific challenges and refine their strategies.

- Real-Time Application: Practice interpreting live market data with expert guidance, gaining the confidence to apply these insights in real trading situations.

Who Should Enroll?

This course is ideal for experienced traders looking to incorporate order flow into their trading strategies. Whether trading stocks, futures, or forex, participants will benefit from in-depth market analysis, strategic insights, and direct support from experts in the field. With Orderflows Gems 2: Private Sessions, traders are equipped with advanced techniques to sharpen their edge in competitive markets.