Description

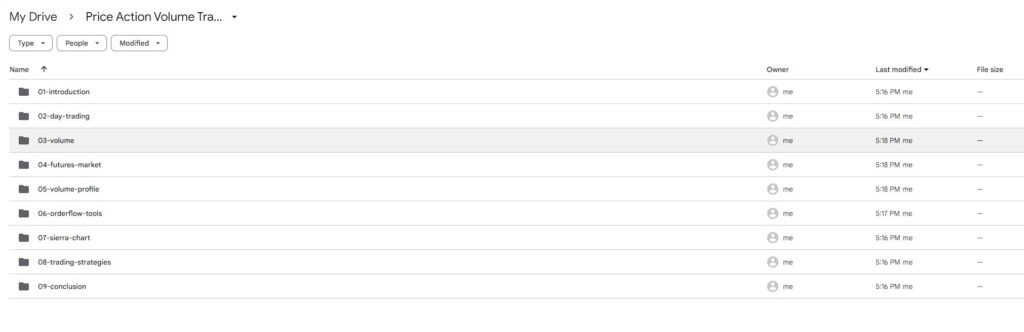

Download Proof | Price Action Volume Trader – Day Trading With Volume Profile and Orderflow (5.64 GB)

![]()

Price Action Volume Trader – Day Trading With Volume Profile and Orderflow

The Price Action Volume Trader course offers a deep dive into the intricate world of day trading, leveraging volume profile and order flow analysis to inform strategic decision-making. Designed for traders seeking to refine their skills and gain a competitive edge in the markets, this course provides comprehensive training on how to interpret price action alongside volume data to identify high-probability trading opportunities.

Led by seasoned trading experts, the Price Action Volume Trader course covers a range of essential topics essential for mastering day trading with volume profile and order flow:

- Understanding Price Action: Participants will gain a thorough understanding of price action—the movement of a security’s price over time—and its significance in technical analysis. By learning to interpret price action patterns and candlestick formations, traders can identify market trends, reversals, and potential trade setups with precision.

- Volume Profile Analysis: The course delves into volume profile analysis, a powerful tool for understanding the distribution of trading activity at various price levels. Participants will learn how to interpret volume profile charts to identify key support and resistance levels, gauge market sentiment, and anticipate potential price movements.

- Order Flow Analysis: Order flow analysis provides valuable insights into the buying and selling activity occurring in the market in real-time. Participants will learn how to interpret order flow data, including bid-ask spreads, market depth, and trade volume, to gauge market dynamics and identify areas of liquidity and potential trading opportunities.

- Developing Trading Strategies: Armed with a solid understanding of price action, volume profile, and order flow analysis, participants will learn how to develop and implement effective day trading strategies. From scalping to momentum trading, the course explores various trading styles and techniques tailored to different market conditions and trading preferences.

- Risk Management: Effective risk management is crucial for preserving capital and maximizing long-term profitability in day trading. The course emphasizes the importance of risk management principles, including position sizing, stop-loss placement, and risk-reward ratios, to help traders minimize losses and protect their trading accounts.

- Practical Application and Live Trading: Throughout the course, participants will have the opportunity to apply their knowledge in simulated trading environments or real-time market scenarios. By practicing trading strategies in a controlled setting, traders can hone their skills, build confidence, and prepare for live trading with real money.

By the end of the Price Action Volume Trader course, participants will have gained the knowledge, skills, and confidence to navigate the fast-paced world of day trading with volume profile and order flow analysis. Whether you’re a novice trader looking to build a solid foundation or an experienced trader seeking to refine your skills, this course offers invaluable insights and resources to help you succeed in the dynamic and competitive world of day trading. With expert guidance and practical training, you’ll be well-equipped to seize opportunities, manage risk, and achieve your trading goals in the financial markets.