Description

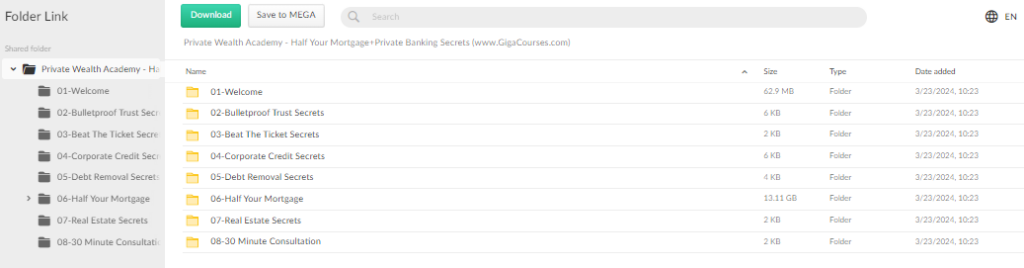

Download Proof | Private Wealth Academy – Half Your Mortgage+Private Banking Secrets (13.17 GB)

![]()

Private Wealth Academy – Half Your Mortgage+Private Banking Secrets

Unlocking Financial Freedom: The Eight Core Components of Real Estate Investment Mastery

Are you tired of feeling overwhelmed by mortgage payments? Are you eager to take control of your finances and build wealth through real estate investment? Look no further than our program’s eight essential core components, designed to empower you on your journey to financial independence.

1. Half Your Mortgage: Mastering Mortgage Reduction

In the first session, “Half Your Mortgage,” you’ll learn how to slash your mortgage in half and save up to 87% on interest payments overall. This transformative technique enables you to own three or four properties free and clear in less than 30 years, unlocking immense wealth-building potential in real estate investment.

2. The 7 Scams of Every Mortgage: Understanding Financial Tactics

Every mortgage contains hidden costs and pitfalls, from escrow to miscellaneous fees. In the second lesson, “The 7 Scams of Every Mortgage,” you’ll gain insight into the financial system’s inner workings, empowering you to navigate mortgage agreements with confidence and avoid falling prey to deceptive tactics.

3. HELOC Secrets: Leveraging Home Equity for Investment

Unlocking the power of Home Equity Lines of Credit (HELOCs) is the focus of the third module. Learn how to maximize your HELOC to invest in real estate and amplify your wealth-building opportunities. Seize the chance to expand your real estate portfolio and capitalize on current economic conditions.

4. Credit Optimization: Maximizing Financing Opportunities

Module four delves into credit optimization, teaching you how to elevate your credit score and secure better financing options for real estate investment. With a higher credit score, you’ll gain access to more favorable lending terms and capitalize on a broader range of investment opportunities.

5. Real Estate Investment Strategies: Identifying Opportunities

Explore the intricacies of real estate investment in module five. From spotting lucrative deals to evaluating properties and crafting a portfolio expansion strategy, this module equips both novice and seasoned investors with essential knowledge and tools for success.

6. Tax Planning Techniques: Minimizing Tax Liability

Module six focuses on tax planning strategies tailored for real estate investors. Discover how to reduce your tax burden and retain more of your earnings, enabling you to reinvest funds into expanding your real estate business and maximizing long-term growth.

7. Asset Protection: Safeguarding Your Investments

Protecting your assets is paramount as a real estate investor. Module seven covers essential asset protection strategies, guiding you in establishing legal frameworks to shield your investments from potential claims and risks.

8. Cultivating a Winning Mindset: Overcoming Challenges

The final module underscores the importance of attitude in real estate investment success. Cultivating a resilient mindset is crucial for navigating the challenges inherent in the industry. Learn the skills and techniques needed to maintain a positive outlook and overcome obstacles with confidence.

Conclusion: Empowering Your Real Estate Journey

In conclusion, these eight core components provide a comprehensive curriculum for anyone looking to build wealth through real estate investment. Whether you’re a beginner or seasoned investor, this curriculum equips you with the knowledge and tools needed to succeed. Don’t wait any longer—take control of your financial future and embark on your real estate journey today!