Description

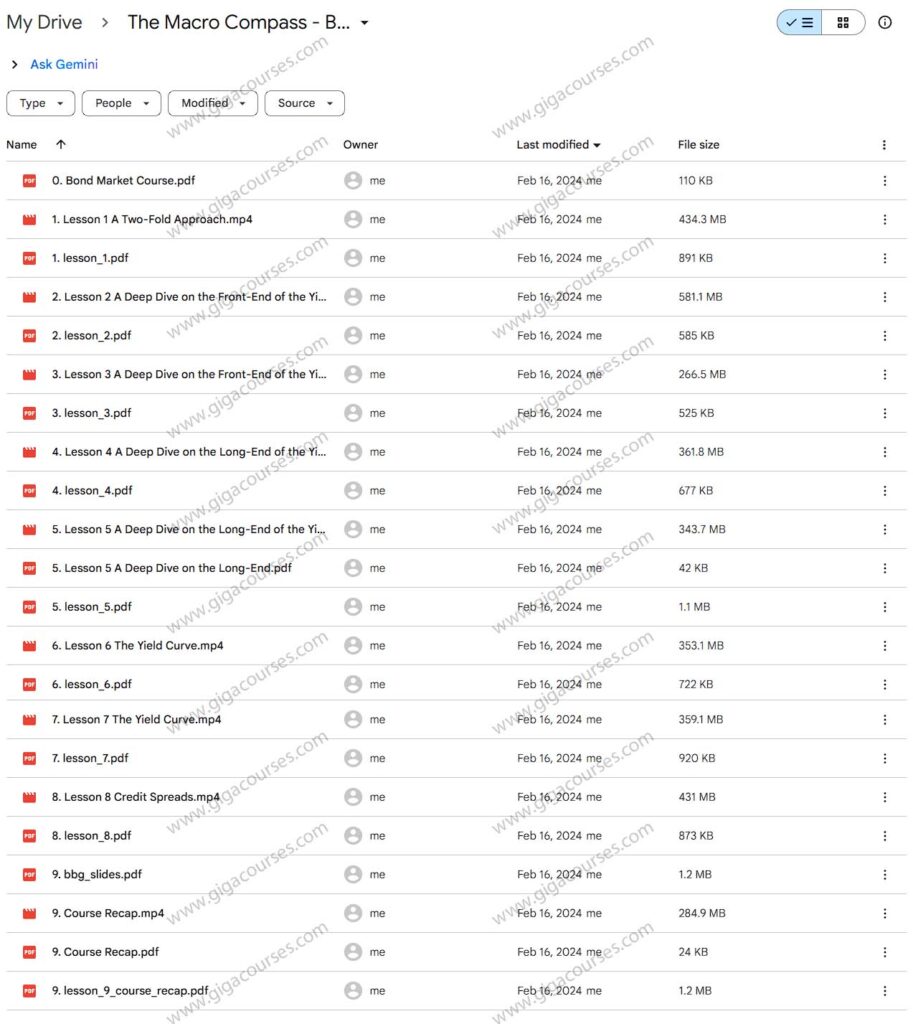

Download Proof | The Macro Compass – Bond Market Course (3.34 GB)

![]()

The Macro Compass – Bond Market Course

The Bond Market Course by The Macro Compass, created by former hedge fund manager Alf Peccatiello, is an in-depth educational experience focused on understanding the mechanics, pricing, and macroeconomic implications of the global bond market. Designed for intermediate to advanced investors and traders, the course bridges the gap between theoretical macro concepts and real-world bond market application.

Course Structure and Content

The course is divided into several modules, progressing from foundational concepts to more complex macro applications. Key modules include:

- Introduction to Fixed Income Instruments

- Yield Curves and What They Signal

- Interest Rates, Inflation, and Central Bank Policies

- Bond Pricing and Duration Concepts

- Macro Cycles and How Bonds React

- Real-World Trade Setups and Macro Frameworks

Each module is paired with clear visuals, charts, and spreadsheets, helping learners grasp the data-heavy content with clarity.

Teaching Style and Delivery

Alf brings a unique blend of academic insight and practical trading experience. His teaching style is both approachable and intellectually rigorous. He doesn’t rush through content but instead explains key ideas like term premiums, real yields, and forward rate expectations with the patience needed to master them.

He also frequently contextualizes lessons with real-time market commentary, making the material immediately applicable to current macroeconomic conditions.

Unique Selling Points

- Real Hedge Fund Insight

Unlike academic-style courses or superficial YouTube content, this course offers insights rooted in Alf’s experience managing billions at a global macro hedge fund. The strategies, indicators, and frameworks discussed are those used by institutional players.

- Macro Meets Execution

While macroeconomic theory is often abstract, this course makes it actionable. Alf connects bond market signals to portfolio decisions, helping investors understand when and why to act—not just what’s happening.

- Forward-Thinking Curriculum

With a focus on how to read yield curves, interpret central bank policy, and anticipate macro shifts, the course is highly relevant to traders in today’s volatile rate environment.

Practical Application

The course stands out for its emphasis on how bond market dynamics influence everything—from equity valuations to currency movements. Alf includes examples of how to interpret 2s10s and 5s30s yield curve inversions, build macro frameworks, and incorporate rate expectations into investment strategy.

There are also worksheets and templates included for building your own macro dashboards and rate models.

Pricing and Value

The Bond Market Course is moderately priced for its niche, especially considering the professional-grade content. It’s an excellent investment for:

- Portfolio managers

- Macro-focused traders

- CFA students or finance professionals

- Retail investors seeking institutional-level macro knowledge

While it may feel dense for beginners, it’s pure gold for those with basic financial literacy looking to go deeper.

- Exceptional macro clarity

- Hedge fund-level insights made accessible

- Real-world application of concepts

Final Verdict

The Macro Compass – Bond Market Course is a masterclass in understanding fixed income through a macro lens. It’s a rare course that combines theory, strategy, and execution with the credibility of real-world experience. For anyone serious about macro investing or understanding the rate-driven world of finance, this course is essential.