Description

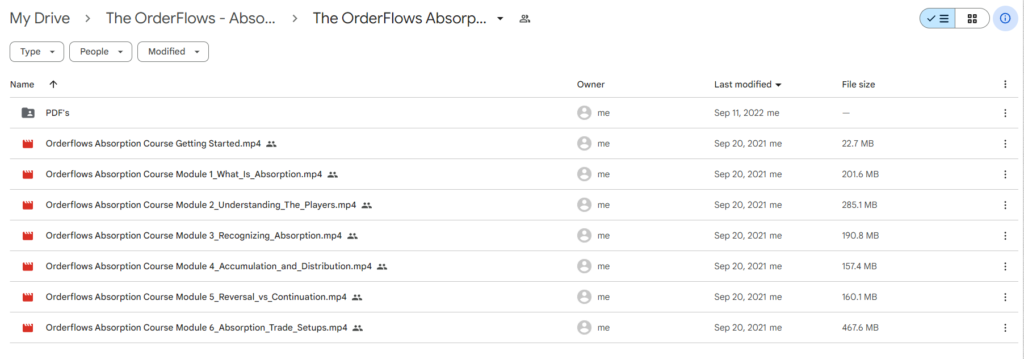

Download Proof | The OrderFlows – Absorption Course (1.59 GB)

![]()

The OrderFlows – Absorption Course

Introduction: The OrderFlows Absorption Course is a specialized program designed to enhance traders’ understanding of market dynamics and optimize trading decisions based on order flow analysis. Developed by industry experts, this course provides a comprehensive exploration of absorption trading strategies, focusing on identifying and capitalizing on key market turning points.

Foundations of Order Flow Analysis: The course begins by establishing a solid foundation in order flow analysis. Participants learn to interpret the ebb and flow of market orders, gaining insights into the behavior of market participants. Understanding the nuances of order flow is essential for traders seeking to navigate intraday price movements and make informed decisions.

Identification of Absorption Patterns: A central theme of the OrderFlows Absorption Course is the identification of absorption patterns. Traders are guided through recognizing instances where aggressive buying or selling is absorbed by opposing market participants. This level of granularity enables participants to pinpoint potential trend reversals and assess the strength of prevailing market trends.

Advanced Techniques in Tape Reading: Building on the basics, the course delves into advanced techniques in tape reading. Participants learn how to analyze the tape for subtle cues and nuances that may indicate absorption. This includes deciphering changes in order book dynamics, tracking large orders, and interpreting the speed of price movements. Mastery of these techniques is crucial for traders aiming to stay ahead of market shifts.

Practical Application in Live Markets: One of the distinctive features of the Absorption Course is its emphasis on practical application. Traders have the opportunity to witness the concepts in action through live market examples. This real-time application ensures that participants can observe absorption patterns in various market conditions and develop the skills needed for effective decision-making.

Risk Management Strategies: Understanding the importance of risk management in trading, the course integrates strategies for effectively managing risk. Participants learn how to apply absorption analysis within the context of a comprehensive risk management plan. This ensures that traders can protect their capital while seeking opportunities based on order flow dynamics.

Customized Trading Plans: Recognizing that every trader has a unique style, the course encourages the development of customized trading plans. Participants are guided in tailoring absorption-based strategies to align with their risk tolerance, trading objectives, and preferred market instruments. This personalized approach fosters adaptability and consistency in trading.

Community Interaction and Support: The OrderFlows Absorption Course prioritizes community interaction and support. Traders gain access to a community where they can engage with instructors and fellow participants. This collaborative environment provides a platform for sharing insights, discussing trade ideas, and seeking clarification on absorption concepts.

Continuous Learning and Updates: Acknowledging the dynamic nature of financial markets, the course is designed for continuous learning. Participants receive updates on market conditions, additional resources, and supplementary materials to enhance their absorption trading skills. This commitment to ongoing education ensures that traders remain well-equipped to navigate evolving market scenarios.

Conclusion: The OrderFlows Absorption Course emerges as a comprehensive and practical resource for traders seeking to master absorption-based trading strategies. By covering foundational order flow analysis, absorption pattern identification, advanced tape reading techniques, live market application, risk management, customized trading plans, community interaction, and continuous learning, the course equips participants with the tools needed for success in the dynamic world of intraday trading. The focus on absorption patterns adds a nuanced layer to traders’ skill sets, providing them with a strategic advantage in interpreting and responding to market movements.