Description

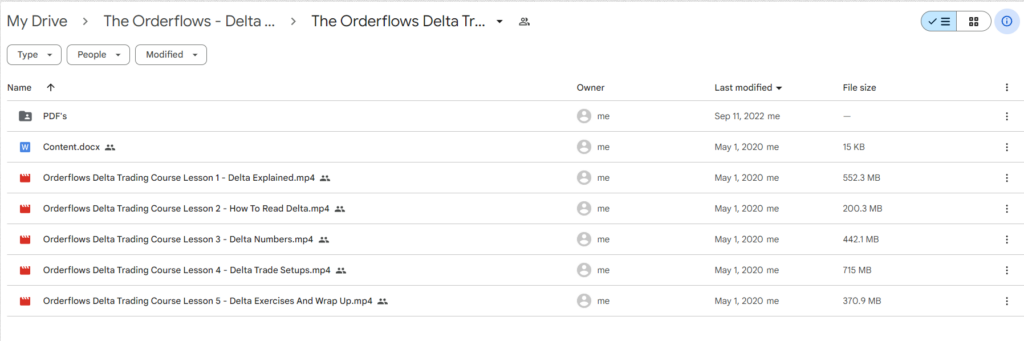

Download Proof | The Orderflows – Delta Trading Course (2.26 GB)

![]()

The Orderflows – Delta Trading Course

Introduction: The Orderflows Delta Trading Course is an advanced educational program tailored for traders seeking to enhance their skills in reading and interpreting order flow and delta analysis. Developed by seasoned traders, this course is designed to provide participants with a deep understanding of market dynamics and insights into using order flow information for more informed trading decisions.

**1. Understanding Order Flow: The foundation of the Orderflows Delta Trading Course lies in comprehending order flow dynamics. Participants are likely introduced to the intricacies of how buy and sell orders impact price movements. The course may cover concepts such as bid-ask spreads, order book imbalances, and the significance of order flow data in determining market sentiment.

2. Delta Analysis Fundamentals: Delta analysis, a key component of the course, involves studying the relationship between price changes and changes in the open interest of contracts. Participants may learn how to interpret delta values to gain insights into the strength of buying or selling pressure in the market. This fundamental knowledge forms the basis for more nuanced trading strategies.

3. Advanced Technical Analysis Tools: The Orderflows Delta Trading Course likely incorporates advanced technical analysis tools to enhance participants’ trading capabilities. This may include using cumulative delta charts, footprint charts, and other specialized indicators to gain a granular view of order flow dynamics. Understanding these tools can provide a significant edge in decision-making.

4. Trading Strategies Based on Delta: A central focus of the course is likely on developing trading strategies based on delta analysis. Participants may explore how to identify key entry and exit points by leveraging order flow information. The course may cover scalping, swing trading, and position trading strategies tailored to capitalize on delta imbalances and market inefficiencies.

5. Risk Management in Delta Trading: Effective risk management is emphasized in the Orderflows Delta Trading Course. Participants may learn how to assess and manage risk in the context of delta trading strategies. This includes setting appropriate stop-loss levels, position sizing based on market conditions, and adapting risk management strategies to the nuances of order flow.

6. Real-Time Application through Simulations: Practical application is integral to the learning process, and the course may provide participants with opportunities for real-time application through trading simulations. Simulated trading scenarios allow participants to practice applying delta analysis in a controlled environment, honing their skills before executing trades in live markets.

7. Market Profile and Auction Market Theory: To complement delta analysis, the course may delve into market profile and auction market theory. Participants may gain insights into how these concepts intersect with order flow dynamics, providing a more holistic understanding of market structure and behavior. This integration enhances participants’ ability to make informed trading decisions.

8. Continuous Learning and Updates: Given the dynamic nature of financial markets, the Orderflows Delta Trading Course likely emphasizes the importance of continuous learning and staying abreast of market developments. Updates and ongoing support may be provided to ensure that participants are equipped with the latest insights and strategies to navigate evolving market conditions.

Conclusion: The Orderflows Delta Trading Course offers a comprehensive and advanced curriculum for traders seeking to master order flow and delta analysis. By covering foundational concepts, advanced technical tools, trading strategies, risk management, and real-time application through simulations, the course provides a thorough education in the nuances of delta trading. With a commitment to continuous learning and updates, the course caters to traders aspiring to stay ahead in the ever-evolving landscape of financial markets.