Description

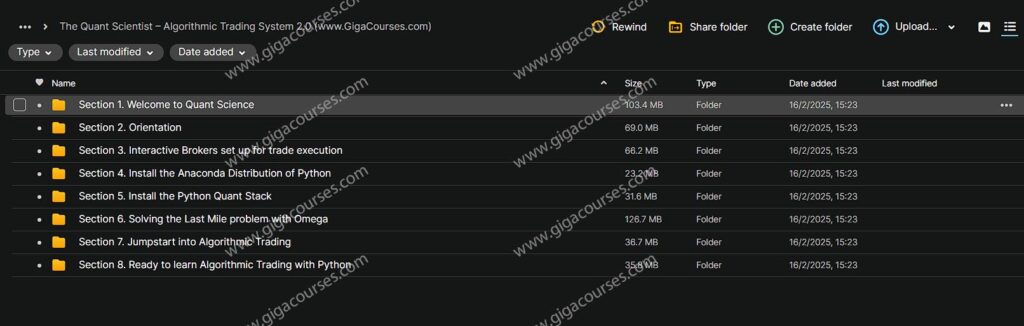

Download Proof | The Quant Scientist – Algorithmic Trading System 2.0 (492.7 MB)

![]()

Option Omega Academy – 1DTE Crash Course

The 1DTE Crash Course offered by Option Omega Academy is designed to equip traders with strategies to capitalize on overnight risk premiums with minimal market exposure. This course focuses on identifying and exploiting price irregularities in 1-day-to-expiration (1DTE) options, providing a structured approach to enhance trading efficiency.

The Quant Scientist – Algorithmic Trading System 2.0

The Quant Scientist – Algorithmic Trading System 2.0 is a comprehensive course designed for traders, investors, and data enthusiasts who want to master algorithmic trading. It covers everything from the fundamentals of quantitative trading to building fully automated trading strategies.

Course Highlights

- Learn algorithmic trading from scratch – no prior coding experience required.

- Hands-on implementation using Python and financial data analysis.

- Covers machine learning and deep learning applications in trading.

- Automated trading strategies using real-world market data.

- Risk management and portfolio optimization techniques.

Who is This Course For?

This course is ideal for:

- Beginners interested in algorithmic trading.

- Traders looking to automate their strategies.

- Data scientists wanting to apply AI/ML to financial markets.

- Finance professionals seeking to enhance quantitative skills.

Course Structure

- Introduction to Algorithmic Trading

- Overview of algorithmic trading and its advantages.

- Understanding market inefficiencies and quantitative strategies.

- Introduction to Python and data analysis libraries.

- Market Data and Preprocessing

- Accessing real-world market data (stocks, forex, crypto).

- Data cleaning, feature engineering, and handling missing values.

- Time series analysis and visualization techniques.

- Trading Strategy Development

- Mean reversion vs. momentum strategies.

- Statistical arbitrage and pairs trading.

- Implementing backtesting frameworks to evaluate strategies.

- Machine Learning in Trading

- Supervised vs. unsupervised learning for financial data.

- Feature selection and model training.

- Sentiment analysis and NLP-based trading models.

- Deep Learning & Reinforcement Learning

- Neural networks for stock price prediction.

- Reinforcement learning for trade execution.

- Building AI-driven trading bots.

- Risk Management & Portfolio Optimization

- Understanding risk-adjusted returns.

- Position sizing and stop-loss techniques.

- Modern Portfolio Theory and asset allocation.

- Live Trading & Automation

- Connecting trading algorithms to brokerage APIs.

- Order execution and trade automation.

- Monitoring performance and risk in real-time.

Key Benefits

- Gain hands-on experience in Python and ML for trading.

- Build and backtest custom trading strategies.

- Learn to integrate AI-driven models in finance.

- Understand risk management for sustainable trading.

- Automate trading strategies for different asset classes.

Conclusion

The Quant Scientist – Algorithmic Trading System 2.0 is a valuable course for anyone looking to dive into algorithmic trading. Whether you’re a trader, investor, or data scientist, this course provides the tools to build, test, and automate profitable trading strategies.