Description

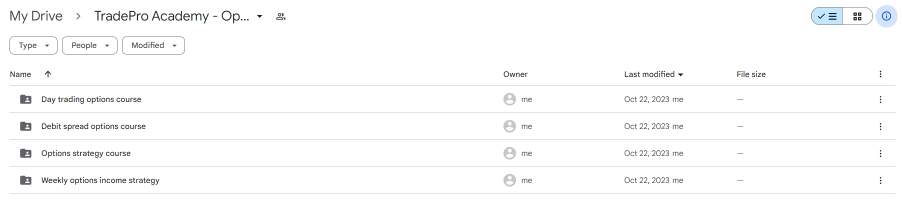

Download Proof | TradePro Academy – Options Trading and Order Flow Course (7.29 GB)

![]()

TradePro Academy – Options Trading and Order Flow Course

Introduction: TradePro Academy unveils its comprehensive ‘Options Trading and Order Flow Course,’ a meticulously crafted educational program aimed at providing individuals with the expertise needed to navigate the complexities of options trading and understand the subtleties of order flow. This course is strategically designed to equip students with both fundamental knowledge and advanced strategies, fostering informed decision-making within the dynamic landscape of financial markets.

Exploring the Course: Introduction to Options Trading The course initiates with a thorough exploration of the foundations of options trading, covering essential concepts like calls, puts, strike prices, and expiration dates. Participants gain insights into the unique characteristics and advantages of options as financial instruments.

Options Pricing Models Delving deeper, the curriculum encompasses various options pricing models, including the renowned Black-Scholes model. Participants understand the factors influencing option prices, such as implied volatility and time decay, enhancing their ability to evaluate and predict price movements effectively.

Risk Management Strategies Recognizing the critical role of risk management in trading, the course imparts techniques like position sizing, stop-loss orders, and portfolio diversification. These strategies empower participants to mitigate risks associated with options trading.

Order Flow Analysis A key focus of the course is mastering order flow analysis. Participants learn to interpret order book data, gauge market depth, and track buying and selling pressures in real-time, providing a strategic advantage in identifying market trends and reversals.

Advanced Options Strategies Moving beyond basics, the curriculum explores advanced options strategies such as spreads, straddles, and iron condors. Participants discover how to effectively use these strategies for hedging, speculation, and achieving consistent returns.

Implied Volatility and Skew Analysis The course emphasizes analyzing implied volatility and skew to make well-informed decisions based on market sentiment.

Options Greeks and Sensitivities In-depth exploration of the Greeks (Delta, Gamma, Theta, and Vega) equips participants to understand their impact on options positions and apply them in crafting effective trading strategies.

Market Sentiment Analysis Participants gain insights into understanding market sentiment through various indicators and sentiment analysis tools.

Trading Psychology Addressing the psychological aspects of trading, the course provides strategies to maintain emotional balance while making crucial trading decisions.

Practical Application: The course incorporates practical elements, allowing participants to engage in simulated trading scenarios and real market data analysis, providing hands-on experience to reinforce theoretical concepts.

Conclusion: TradePro Academy’s ‘Options Trading and Order Flow Course’ stands as a pinnacle in comprehensive education, covering options trading, order flow analysis, and risk management. Its practical approach empowers participants to navigate the world of options trading confidently and immediately apply acquired strategies in real-world scenarios. Whether one is a novice seeking a solid foundation or an experienced trader looking to refine strategies, this course provides a competitive edge in the ever-evolving world of options trading. Downloading the course promises a transformative journey into advanced trading strategies and market intricacies, offering a valuable resource for those aiming to master the art of options trading.