Description

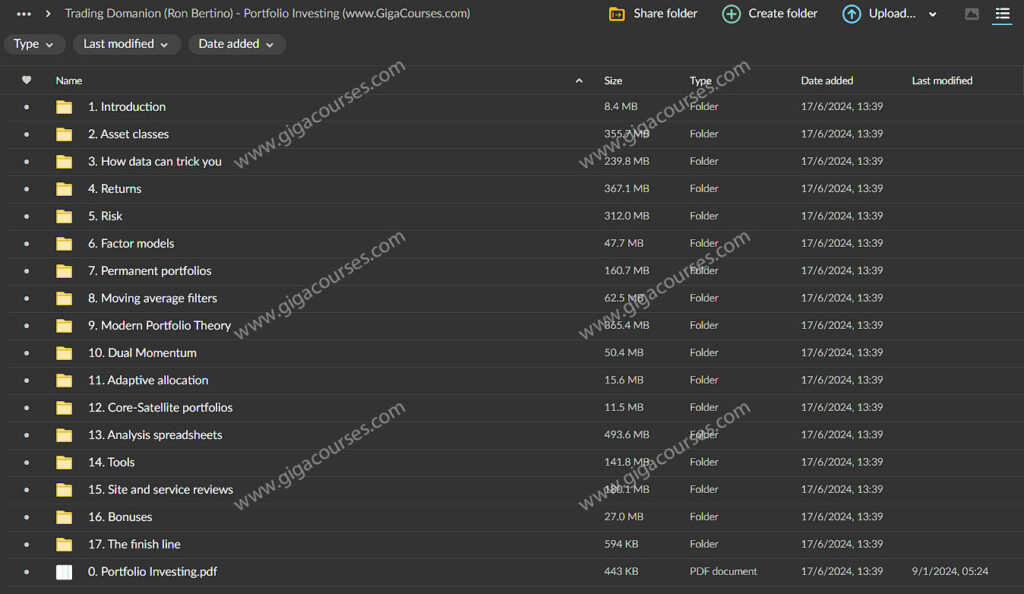

Download Proof | Trading Dominion – Portfolio investing (2.77 GB)

![]()

Trading Dominion – Portfolio Investing: Mastering the Art of Wealth Management

Exploring the Strategies of Trading Dominion

- Introduction to Portfolio Investing:

- Trading Dominion introduces Portfolio Investing as a comprehensive approach to wealth management and financial growth.

- With a focus on diversification and long-term asset allocation, Portfolio Investing aims to optimize risk-adjusted returns and achieve financial goals.

- Understanding Trading Dominion’s Approach:

- Trading Dominion’s Portfolio Investing course provides participants with the knowledge and tools needed to build and manage diversified investment portfolios.

- Through a combination of strategic asset allocation, risk management techniques, and market analysis, participants learn to navigate the complexities of the financial markets.

- Key Components of the Course:

- Asset Allocation Strategies:

- Guidance on designing optimal asset allocation strategies based on individual risk tolerance, investment objectives, and time horizon.

- Strategies for balancing asset classes such as stocks, bonds, real estate, and alternative investments to achieve diversification and minimize portfolio volatility.

- Risk Management Techniques:

- Techniques for assessing and mitigating investment risks through diversification, asset allocation, and hedging strategies.

- Insights into managing portfolio downside risk, including stop-loss orders, position sizing, and portfolio rebalancing to protect capital and preserve wealth.

- Market Analysis and Research:

- Methods for conducting fundamental and technical analysis to identify investment opportunities and assess market trends.

- Tools and resources for researching individual securities, analyzing financial statements, and evaluating valuation metrics to make informed investment decisions.

- Portfolio Construction and Optimization:

- Strategies for constructing well-balanced investment portfolios tailored to specific risk-return profiles and financial objectives.

- Techniques for optimizing portfolio performance through asset allocation adjustments, portfolio rebalancing, and tactical asset allocation based on market conditions.

- Asset Allocation Strategies:

- Benefits of the Course:

- Long-Term Wealth Accumulation:

- Empowers participants to build wealth over the long term through disciplined portfolio investing strategies.

- Provides a framework for systematically saving and investing money to achieve financial independence and retirement goals.

- Risk Mitigation and Capital Preservation:

- Helps participants mitigate investment risks and preserve capital through prudent risk management techniques and diversification.

- Minimizes portfolio volatility and downside exposure, ensuring resilience during market downturns and economic uncertainties.

- Financial Independence and Freedom:

- Enables participants to take control of their financial futures and achieve greater financial independence and freedom.

- Provides the knowledge and skills needed to generate passive income, grow wealth, and create a secure financial foundation for themselves and their families.

- Professional Development and Growth:

- Enhances participants’ investment knowledge and expertise, empowering them to make better financial decisions and navigate the complexities of the financial markets.

- Opens up opportunities for career advancement in the fields of finance, investment management, and wealth advisory.

- Long-Term Wealth Accumulation:

- Testimonials from Course Participants:

- “Trading Dominion’s Portfolio Investing course has transformed my approach to wealth management and investing. It’s a game-changer!” – Individual investor.

- “The practical strategies and insights shared in the course have enabled me to build a diversified investment portfolio and achieve my financial goals.” – Course participant.

- Conclusion:

- Trading Dominion’s Portfolio Investing course equips participants with the knowledge and tools needed to build and manage diversified investment portfolios.

- By focusing on asset allocation, risk management, market analysis, and portfolio construction, participants can optimize risk-adjusted returns, preserve capital, and achieve long-term financial success.