Description

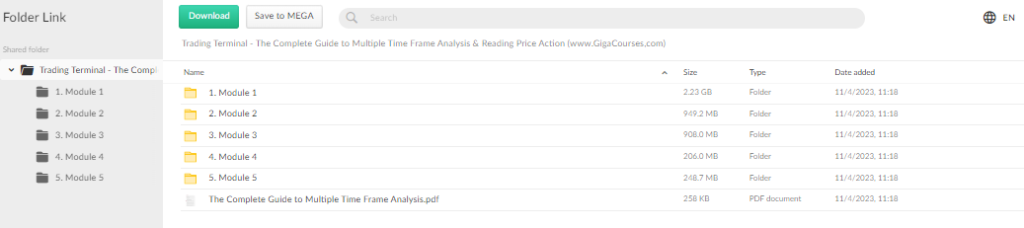

Download Proof | Trading Terminal – The Complete Guide to Multiple Time Frame Analysis & Reading Price Action (4.49 GB)

![]()

Trading Terminal – The Complete Guide to Multiple Time Frame Analysis & Reading Price Action

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action

Introduction: For day traders seeking mastery in chart analysis, understanding price action across multiple time frames is a crucial skill. “The Complete Guide to Multiple Time Frame Analysis & Reading Price Action” is a comprehensive course designed to equip traders with the expertise needed to read and interpret price movements from larger time frames, such as weekly charts, down to the minute-by-minute fluctuations.

Importance of Multiple Time Frame Analysis: Mastering the art of multiple time frame analysis is a prerequisite for day traders, regardless of their chosen strategy or indicators. It goes beyond just using a single time frame and involves a holistic approach to understanding market movements. Analyzing various time frames allows traders to anticipate market directions, identify key entry levels, and make informed decisions. This skill is typically developed through extensive screen time and practice, but this course aims to expedite the learning curve.

Course Content: The curriculum is designed to cover every aspect of reading price action using multiple time frames. It begins with insights into the significance of weekly charts and extends down to the nitty-gritty details of the 1-minute chart. The course is structured to provide a comprehensive understanding of chart reading skills, offering a shortcut to expertise that would otherwise require thousands of hours of practice.

Key Components:

- Comprehensive Time Frame Analysis: The course delves into the nuances of analyzing various time frames, emphasizing the importance of understanding the broader market trends while navigating through shorter time frames for precise entry and exit points.

- Chart Reading Skills: Beyond the use of indicators or specific strategies, the focus is on enhancing chart reading skills. Traders are guided on how to interpret candlestick patterns, identify trend reversals, and make informed predictions based on price movements.

- Decreasing the Learning Curve: Acknowledging that mastering multiple time frame analysis often involves a steep learning curve, the course aims to expedite the process. It provides a structured path to elevate chart reading skills without the need for extensive trial and error.

Skill Enhancement: The primary goal of the course is to enhance the participant’s ability to read charts effectively. By the end of the program, traders should be adept at assessing the market’s direction, recognizing critical support and resistance levels, and making well-informed decisions based on the amalgamation of insights gained from different time frames.

Conclusion: “The Complete Guide to Multiple Time Frame Analysis & Reading Price Action” is a valuable resource for day traders seeking to elevate their chart analysis skills. Whether you’re a novice or an experienced trader, this course aims to equip you with the tools and knowledge necessary to navigate various time frames seamlessly. Enroll now and accelerate your journey to becoming a proficient chart reader in the dynamic world of day trading.