Description

Download Proof | Tao of Trading – Options Academy Elevate (890.2 MB)

![]()

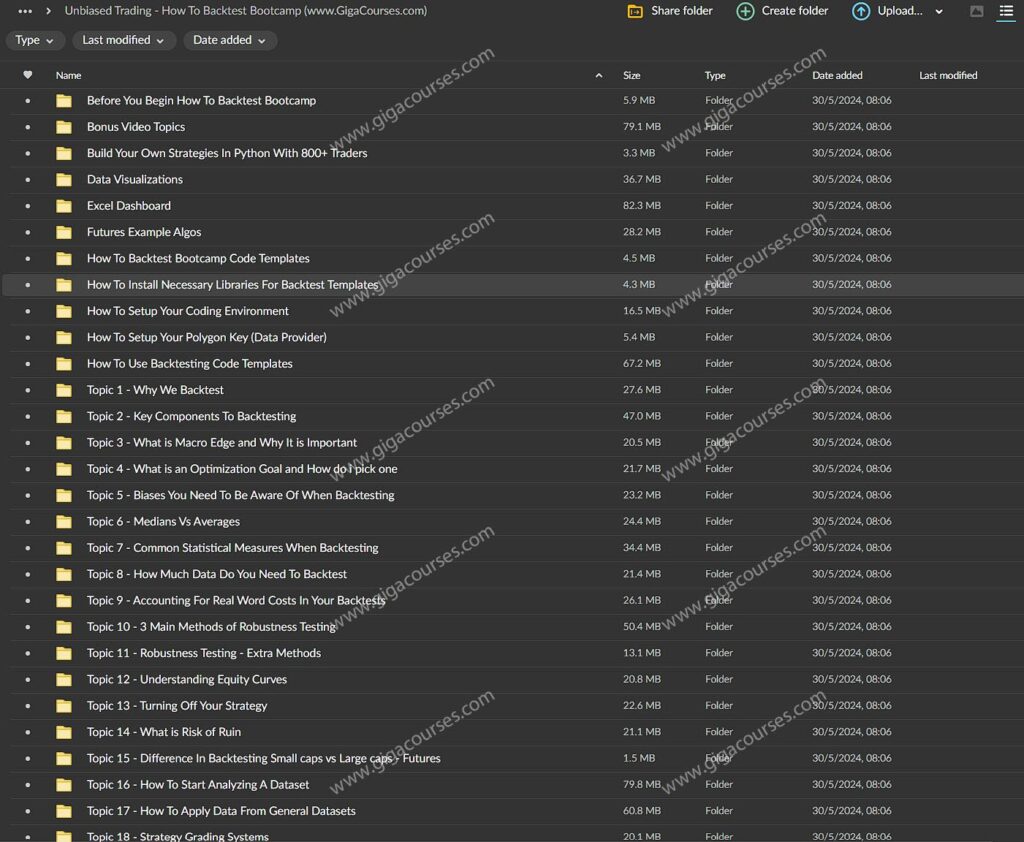

Unbiased Trading – How to Backtest Bootcamp

Backtesting is an essential tool for traders aiming to refine their strategies and improve their trading performance. The Unbiased Trading – How to Backtest Bootcamp is designed to equip traders with the knowledge and skills needed to effectively backtest their trading strategies using historical data. This course emphasizes the importance of objectivity, evaluation, and optimization in the trading process.

Why You Should Backtest

Backtesting is crucial for several reasons, all of which contribute to a more disciplined and effective trading approach. Below are the key benefits and motivations for incorporating backtesting into your trading routine.

Evaluate

Evaluate the Effectiveness of Your Trading Strategy

- Historical Data Analysis: Backtesting allows you to analyze how your trading strategy would have performed in the past by applying it to historical market data. This retrospective analysis helps in understanding the strengths and weaknesses of your strategy.

- Statistical Confidence: By evaluating your strategy against historical data, you gain confidence in its statistical validity. This confidence is rooted in the empirical evidence that the strategy has worked under various market conditions.

- Risk Assessment: Backtesting helps in assessing the risk associated with a trading strategy. You can determine the drawdowns, the consistency of returns, and the potential for unexpected losses.

Become Objective

Enhance Objectivity in Trading

- Data-Driven Decisions: Backtesting shifts your trading decisions from being based on intuition and gut feelings to being grounded in data and empirical evidence. This transition fosters a more disciplined and objective approach.

- Avoid Cognitive Biases: By relying on backtested data, you reduce the risk of cognitive biases such as confirmation bias, where you might only acknowledge information that supports your preconceived notions.

- Emotional Control: Trading often involves high emotions, which can lead to impulsive decisions. Backtesting removes emotion from the equation, ensuring that your trading decisions are based on solid data rather than on emotional reactions.

Optimize

Optimize and Improve Your Trading Strategies

- Identify Weaknesses: Backtesting helps in pinpointing the weaknesses in your trading strategies. By analyzing past performance, you can identify patterns that lead to losses and areas that require adjustments.

- Strategy Refinement: Once weaknesses are identified, you can refine and adjust your strategy to improve its performance. This might involve tweaking entry and exit points, adjusting stop-loss levels, or altering position sizes.

- Continuous Improvement: Backtesting is not a one-time process but an ongoing practice. Regular backtesting allows for continuous improvement of your strategies, adapting to changing market conditions and evolving trading environments.

Course Outline

The Unbiased Trading – How to Backtest Bootcamp is structured to provide a comprehensive understanding of backtesting, from the basics to advanced techniques.

Introduction to Backtesting

- Understanding Backtesting: Definition and importance of backtesting in trading.

- Tools and Software: Overview of popular backtesting tools and platforms.

Setting Up Your Backtest

- Data Collection: How to gather and prepare historical data for backtesting.

- Defining Parameters: Setting up the parameters for your backtest, including entry and exit points, stop-loss, and take-profit levels.

Running Your Backtest

- Executing the Test: Step-by-step process of running a backtest.

- Analyzing Results: How to interpret the results of your backtest and what metrics to focus on.

Optimizing Your Strategy

- Identifying Weaknesses: Techniques for finding weaknesses in your strategy.

- Strategy Refinement: Methods for refining and improving your trading strategy based on backtest results.

- Advanced Techniques: Introduction to advanced backtesting techniques, such as walk-forward analysis and Monte Carlo simulations.

Practical Application

- Case Studies: Real-world examples of backtesting and strategy optimization.

- Interactive Sessions: Hands-on exercises and live backtesting sessions to apply what you’ve learned.

Conclusion

Backtesting is a powerful tool that provides traders with the ability to evaluate, optimize, and enhance their trading strategies. The Unbiased Trading – How to Backtest Bootcamp offers a structured and detailed approach to mastering backtesting, ensuring that traders can make informed, data-driven decisions. By removing emotion from the equation and focusing on empirical evidence, backtesting helps traders achieve better performance and greater confidence in their trading strategies.