Description

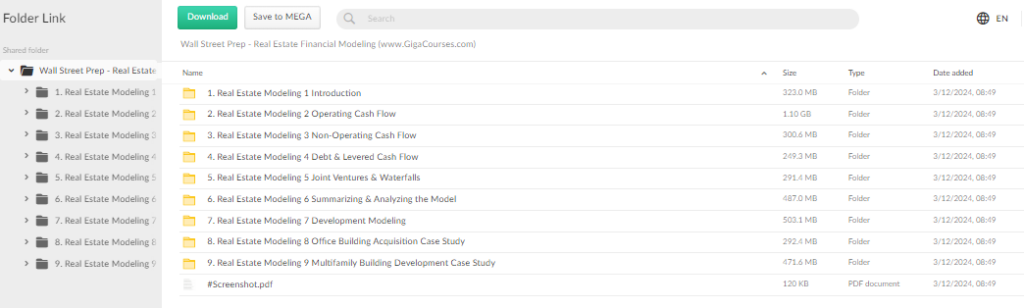

Download Proof | Wall Street Prep – Real Estate Financial Modeling (3.95 GB)

![]()

Wall Street Prep – Real Estate Financial Modeling

Mastering Real Estate Investment Trust (REIT) Modeling Course

Introduction: The Real Estate Investment Trust (REIT) Modeling Course is a crucial asset for professionals in investment banking, equity research, and real estate, offering a specialized focus on building financial and valuation models for REITs. This comprehensive course equips students with the skills necessary to construct accurate models mirroring real-world scenarios.

Understanding the REIT Landscape: The course delves into the distinctive challenges and drivers inherent to the REIT industry. Students gain insights into the tax advantages and structures of UPREITs and DOWNREITs, unraveling the intricacies that define this specialized sector. The objective is to provide a profound understanding of the unique dynamics that shape the REIT landscape.

Hands-On Learning with BRE Properties: A significant highlight of the course is the hands-on experience of building REIT financial and valuation models from scratch. The chosen company for this practical approach is BRE Properties. Following a step-by-step methodology, students navigate through the complexities of modeling same-store properties, acquisitions, developments, and dispositions. This immersive process ensures a grasp of real estate modeling best practices.

Critical Profit Metrics in Focus: Part of the course revolves around essential REIT profit metrics, such as Funds from Operations (FFO), Adjusted Funds from Operations (AFFO), and Cash Available for Distribution (CAD). Students learn to analyze and interpret these metrics, gaining a nuanced understanding of a REIT’s financial health and performance.

Valuation Techniques – Part 1: The second segment of the course shifts focus to valuation techniques. The Net Asset Value (NAV) approach takes center stage, providing students with a comprehensive understanding of how to evaluate a REIT’s worth. This section not only covers basic valuation but extends to multi-year assessments of acquisitions, developments, and dispositions, offering a holistic perspective on valuation dynamics.

Comprehensive Mastery and Application: Upon completion of the course, students emerge with a comprehensive understanding of the REIT industry. The ability to construct and deconstruct financial models for a REIT becomes second nature, reflecting accurate depictions of operations and performance. Moreover, students gain proficiency in utilizing the NAV approach to assess the intrinsic value of a REIT.

Conclusion: The Real Estate Investment Trust (REIT) Modeling Course stands as a beacon for professionals seeking mastery in the intricacies of REIT financial and valuation modeling. With a focus on practical applications, students navigate real-world scenarios using BRE Properties as a case study. From understanding industry nuances to dissecting critical profit metrics and employing advanced valuation techniques, this course ensures participants are well-equipped to excel in the dynamic world of REITs.