Description

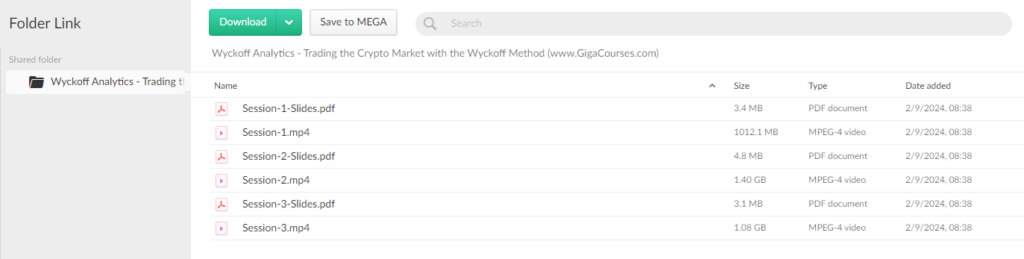

Download Proof | Wyckoff Analytics – Trading the Crypto Market with the Wyckoff Method (3.49 GB)

![]()

Wyckoff Analytics – Trading the Crypto Market with the Wyckoff Method

Title: Wyckoff Analytics – Trading the Crypto Market with the Wyckoff Method

Introduction: The volatile nature of the cryptocurrency market presents both opportunities and challenges for traders. Wyckoff Analytics, a leading provider of trading education, offers a systematic approach to navigate this complexity through the application of the Wyckoff Method. This case study explores how traders can effectively utilize the Wyckoff Method to analyze and trade cryptocurrencies.

Understanding the Wyckoff Method: The Wyckoff Method, developed by Richard D. Wyckoff, emphasizes understanding market dynamics through the analysis of price and volume movements. It focuses on identifying accumulation and distribution phases, determining institutional buying and selling, and making informed trading decisions based on supply and demand dynamics. This method provides a comprehensive framework for analyzing market trends and identifying optimal entry and exit points.

Analyzing Market Structure: Traders at Wyckoff Analytics apply the principles of the Wyckoff Method to analyze the market structure of cryptocurrencies. They assess the overall trend, identify key support and resistance levels, and analyze price and volume interactions to gauge market sentiment. By understanding the underlying market dynamics, traders can anticipate trend reversals and capitalize on profitable trading opportunities.

Identifying Accumulation and Distribution Phases: A fundamental aspect of the Wyckoff Method is identifying accumulation and distribution phases within the cryptocurrency market. Traders use Wyckoff’s principles to recognize patterns of buying and selling pressure, as well as the absorption of supply and demand. By identifying accumulation phases, traders can position themselves for potential price appreciation, while distribution phases signal potential downtrends and opportunities to exit positions.

Applying Wyckoff Principles to Cryptocurrency Charts: Traders leverage Wyckoff principles to analyze cryptocurrency price charts and identify optimal trading setups. They look for signs of accumulation, such as increasing volume and tightening price ranges, which indicate potential accumulation by smart money investors. Conversely, distribution phases are characterized by decreasing volume and widening price spreads, signaling potential distribution by large market participants.

Risk Management and Trade Execution: Incorporating sound risk management principles is integral to successful trading using the Wyckoff Method in the cryptocurrency market. Traders at Wyckoff Analytics implement risk management strategies such as setting stop-loss orders, defining risk-reward ratios, and managing position sizes to protect capital and minimize losses. They execute trades based on confirmations of Wyckoff patterns and adhere to disciplined trading plans.

Continuous Learning and Education: Wyckoff Analytics emphasizes the importance of continuous learning and education for traders to master the Wyckoff Method and stay ahead in the cryptocurrency market. Traders have access to educational resources, live trading webinars, and personalized coaching sessions to deepen their understanding of market dynamics and refine their trading skills. By staying informed and adaptive, traders can navigate the evolving cryptocurrency landscape with confidence.

Conclusion: Trading the cryptocurrency market with the Wyckoff Method offers traders a systematic approach to analyzing market trends, identifying accumulation and distribution phases, and executing profitable trades. Wyckoff Analytics provides traders with the knowledge, tools, and support needed to apply Wyckoff principles effectively and achieve success in the dynamic world of cryptocurrencies. By combining technical analysis with risk management and continuous education, traders can capitalize on opportunities and navigate market volatility with proficiency.