Description

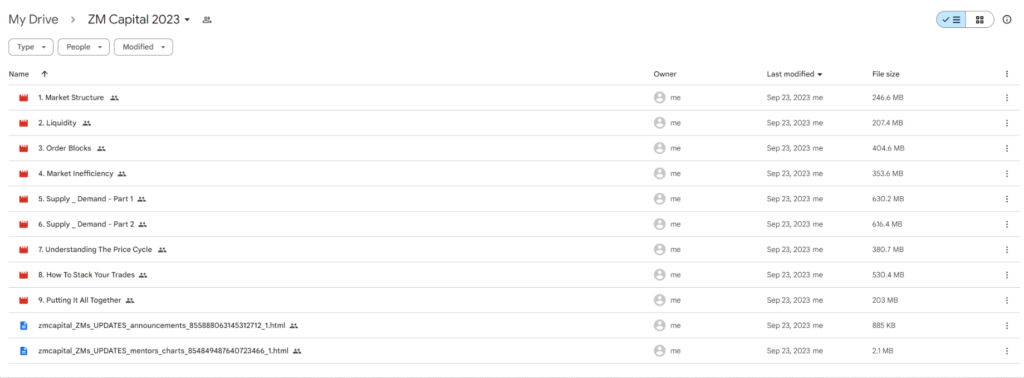

Download Proof | ZM Capital 2023 (3.49 GB)

![]()

Introduction: In 2023, ZM Capital emerged as a pivotal player in the financial landscape, exhibiting notable growth and strategic initiatives. This venture capital firm navigated the dynamic market with a keen eye for promising opportunities and a commitment to fostering innovation.

Investment Portfolio: ZM Capital’s investment portfolio in 2023 showcased a diverse range of sectors, from technology to sustainable energy. The firm demonstrated a forward-looking approach, aligning its investments with emerging trends. Notable additions to the portfolio included cutting-edge startups in artificial intelligence, biotechnology, and renewable energy. This diversified strategy positioned ZM Capital to capitalize on the evolving needs of the global market.

Tech Focus and Innovation: A key highlight for ZM Capital in 2023 was its intensified focus on technology-driven ventures. Recognizing the transformative power of technology, the firm actively sought out startups disrupting traditional industries. This strategic move aimed to not only generate robust returns but also to contribute to the technological evolution that defines the modern business landscape. ZM Capital’s investments in innovative tech firms reflected a commitment to staying at the forefront of industry advancements.

Sustainable Investments: In response to the growing emphasis on sustainability, ZM Capital made strides in supporting environmentally conscious ventures. The year 2023 saw the firm backing startups dedicated to green energy, carbon reduction, and sustainable practices. This dual focus on financial returns and environmental impact demonstrated ZM Capital’s commitment to responsible investing, aligning its interests with the global push for a more sustainable future.

Global Expansion and Strategic Alliances: ZM Capital’s success in 2023 was not confined to its home market. The firm actively pursued global expansion, forging strategic alliances with international partners. These partnerships not only provided access to diverse markets but also facilitated cross-border collaboration, enriching the portfolio with a global perspective. ZM Capital’s adept maneuvering in the complex landscape of international finance solidified its position as a player with a truly global vision.

Impact on Emerging Markets: ZM Capital’s investments had a palpable impact on emerging markets, contributing to economic growth and fostering entrepreneurship. By channeling resources into startups from developing economies, the firm played a role in empowering local talent and catalyzing innovation. This dual approach of seeking financial returns while fostering positive societal impact underscored ZM Capital’s commitment to responsible capitalism.

Adaptability in a Changing Landscape: Navigating the financial landscape in 2023 was no small feat, given the uncertainties and rapid changes. ZM Capital’s ability to adapt to these shifts was a testament to its resilience and strategic acumen. Whether adjusting investment strategies in response to market fluctuations or leveraging emerging opportunities, the firm exhibited agility and foresight in an ever-changing environment.

Conclusion: In conclusion, ZM Capital’s journey in 2023 was marked by strategic investments, technological foresight, and a commitment to global sustainability. The firm’s ability to balance financial objectives with responsible investing underscored its significance in the financial ecosystem. As ZM Capital continues to shape the future of finance, its 2023 endeavors serve as a blueprint for navigating the complexities of a dynamic and interconnected world.